Exhibit 99.1

HIGH ROLLER TECHNOLOGIES, INC COMPANY OVERVIEW 2025 ir.highroller.com

Forward Looking Statements Certain statements in this presentation constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as "believe," "may," "estimate," "continue," "anticipate," "vision," "intend," "should," "plan," "expect," "predict,""potential," "could," "will, "*would," "ongoing," "presentation," "future" or the negative of these terms or other similar expressions. Forward-looking statements include, but are not limited to, such matters as: ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ our ability to manage expansion into the U.S. markets and other markets; our ability to compete in our industry; our expectations regarding our financial performance, including our revenue, costs, EBITDA and Adjusted EBITDA; the sufficiency of our cash, cash equivalents, and investments to meet our liquidity needs; our ability to mitigate and address unanticipated performance problems on our websites, or platforms; our ability to attract, retain, and maintain good relations with our customers; our ability to anticipate market needs or develop new or enhanced offerings and services to meet those needs; our ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to our business both in the U.S. and internationally and our expectations regarding various laws and restrictions that relate to our business; our ability to anticipate the effects of existing and developing laws and regulations, including with respect to taxation, and privacy and data protection that relate to our business; our ability to obtain and maintain licenses or approvals with gambling authorities in the U.S. or in other foreign jurisdictions; our ability to effectively manage our growth and maintain our corporate culture; our ability to identify, recruit, and retain skilled personnel, including key members of senior management; our ability to successfully identify, manage, consummate and integrate any existing and potential acquisitions; our ability to maintain, protect, and enhance our intellectual property; our ability to manage the increased expenses associated and compliance demands with being a public company; our ability to maintain our foreign private issuer status; and other factors detailed in our offering documents. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. Please also refer to the "Risk Factors" sections of our quarterly and annual reports filed with the Securities and Exchange Commission (the "SEC"), including our annual report on form 10-K filed with the SEC on March 21, 2025, and our quarterly report on Form 10-Q filed with the SEC on May 15, 2025.. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Each forward-looking statement speaks only as of the date of the particular statement. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained in this presentation to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. In this presentation, references to “weˮ, “usˮ, “ourˮ, and the “Companyˮ refer to High Roller Technologies, Inc. and its direct and indirect subsidiaries.

Explanatory Notes on Use of Non-GAAP Financial Measures We believe "Adjusted EBITDA," a "non-GAAP financial measure," as such term is defined under the rules of the SEC, is useful in evaluating our operating performance. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA may be helpful to investors because it provides consistency and comparability with past financial performance. However, Adjusted EBITDA is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation is provided within this for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business. We reconcile our non-GAAP financial measure of Adjusted EBITDA to our net income (loss), adjusted to exclude interest expense, provision for (benefit from) income taxes, share-based compensation, foreign exchange loss (gain), depreciation and amortization, impairment, and certain charges or gains resulting from non-recurring or irregular events, if any. For the years ended December 31, 2024, and 2023, as well as the 3 months ended March 21, 2025.

Introducing High Roller ● ● ● ● ● ● ● We operate the award-winning online casino brands High Roller & Fruta Backed by a highly experienced founding and executive team with a proven track record of success We leverage best-in-class proprietary and third-party technologies to offer a highly competitive product Our partnership with industry-leading iGaming acquisition firm, SpikeUp Media, provides us with a significant strategic advantage Our operating profile is focused on high-potential, regulated markets with stable revenue streams We maintain an operational headquarters in Malta, and satellite offces in the US & Europe Our common stock is listed on the NYSE American (ROLR) Casino Operator of the Year 2024 Best Player Retention 2024

We Offer The World's Best Online Casino Games Over 5,000 games from more than 90 leading game providers that players know and trust. 85 more

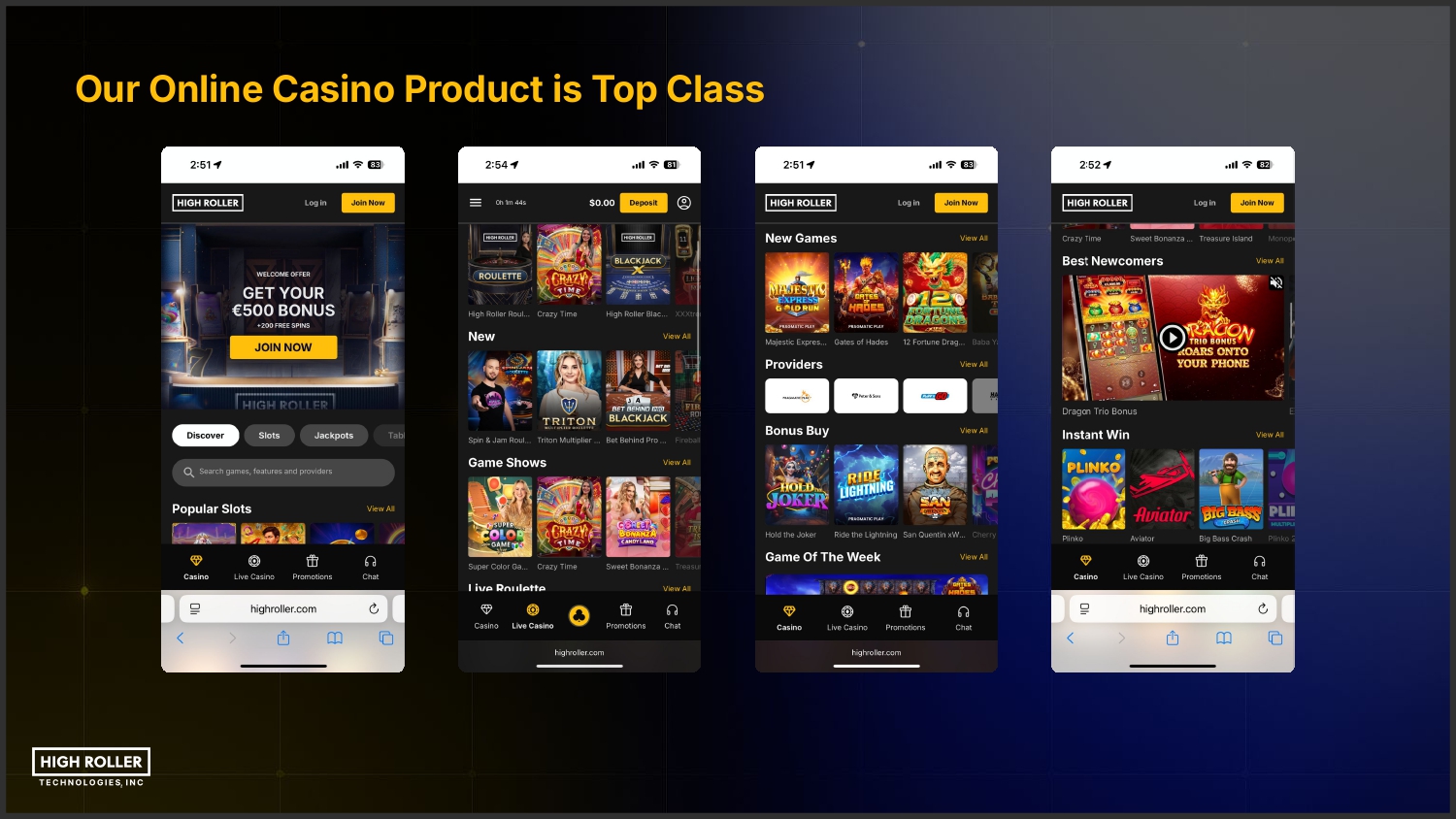

Our Online Casino Product is Top Class

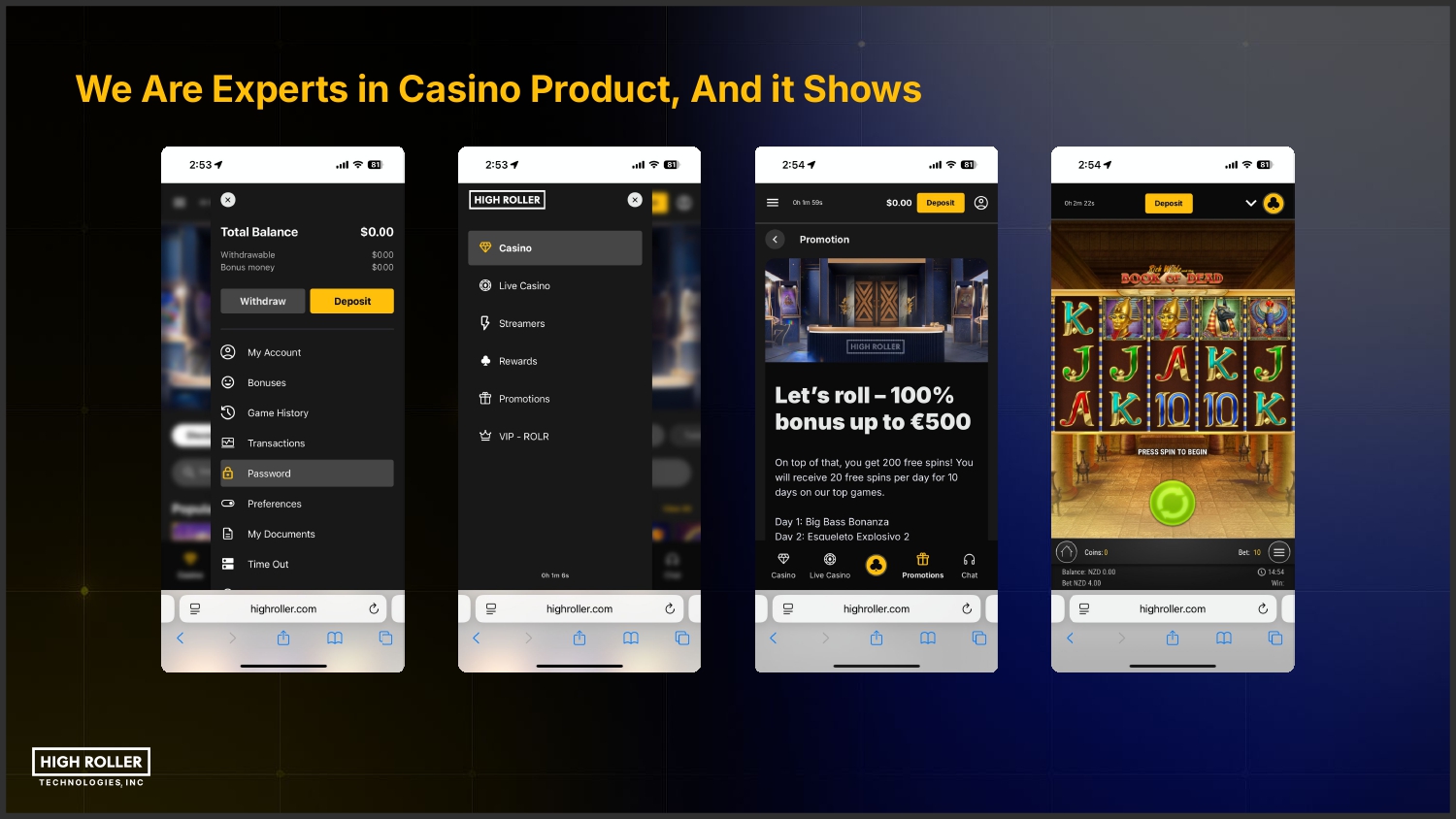

We Are Experts in Casino Product, And it Shows

Our Brands Are Optimized To Be Enjoyed On All Devices

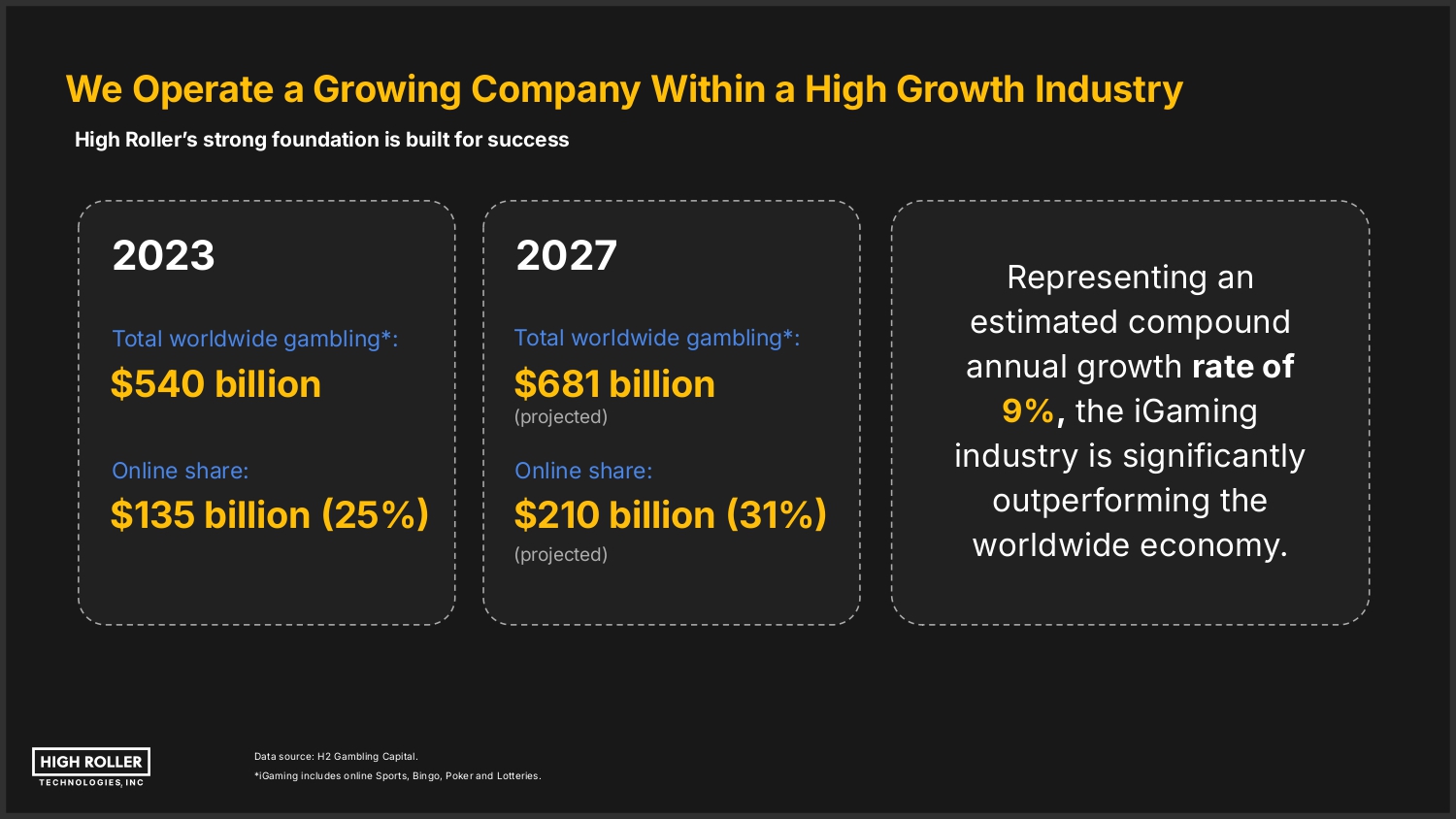

We Operate a Growing Company Within a High Growth Industry High Rollerʼs strong foundation is built for success 2023 2027 Total worldwide gambling*: Total worldwide gambling*: $540 billion $681 billion Online share: Online share: $135 billion 25% $210 billion 31% (projected) (projected) Data source: H2 Gambling Capital. *iGaming includes online Sports, Bingo, Poker and Lotteries. Representing an estimated compound annual growth rate of 9%, the iGaming industry is significantly outperforming the worldwide economy.

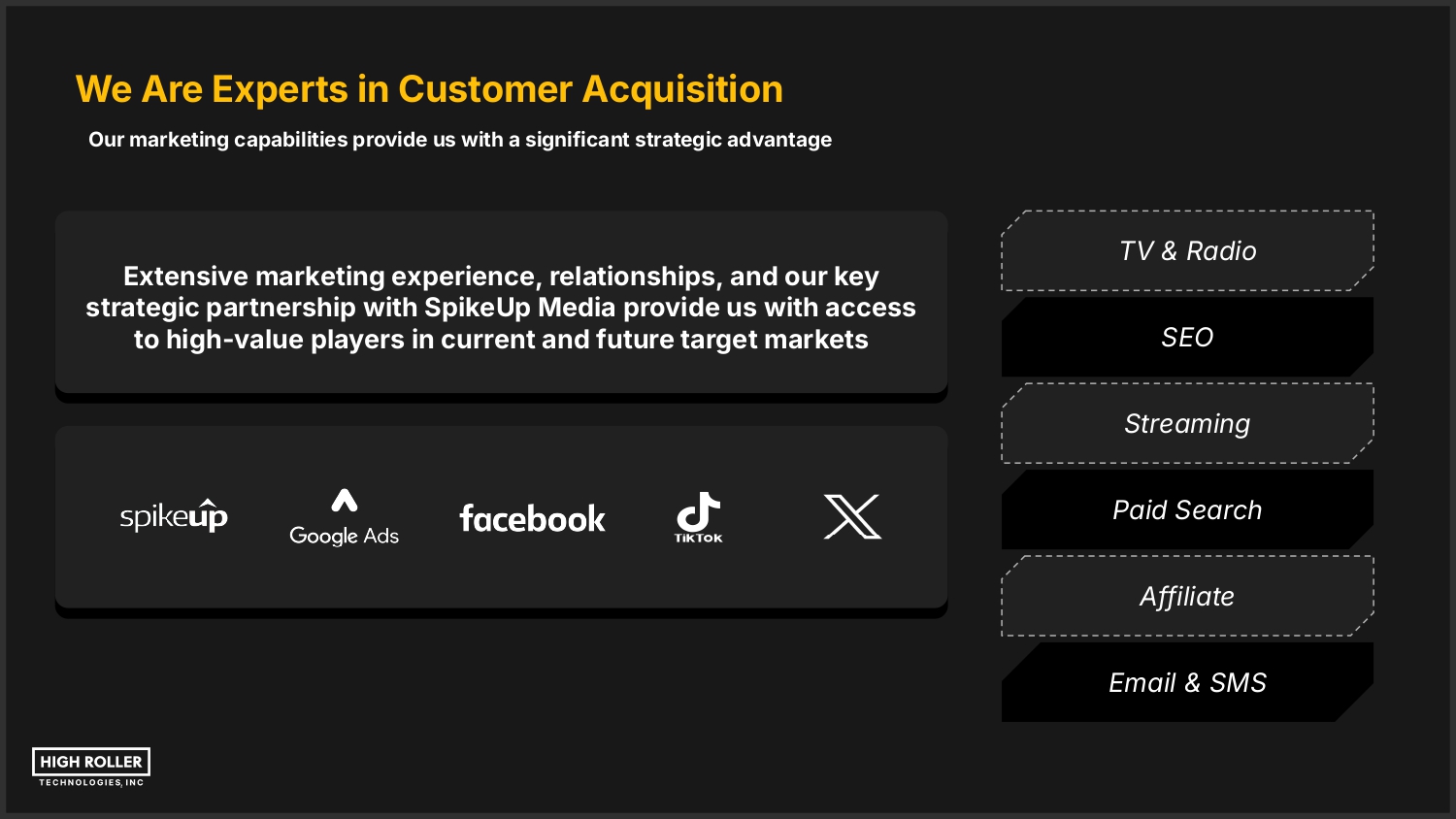

We Are Experts in Customer Acquisition Our marketing capabilities provide us with a significant strategic advantage Extensive marketing experience, relationships, and our key strategic partnership with SpikeUp Media provide us with access to high-value players in current and future target markets TV & Radio SEO Streaming Paid Search Affiliate Email & SMS

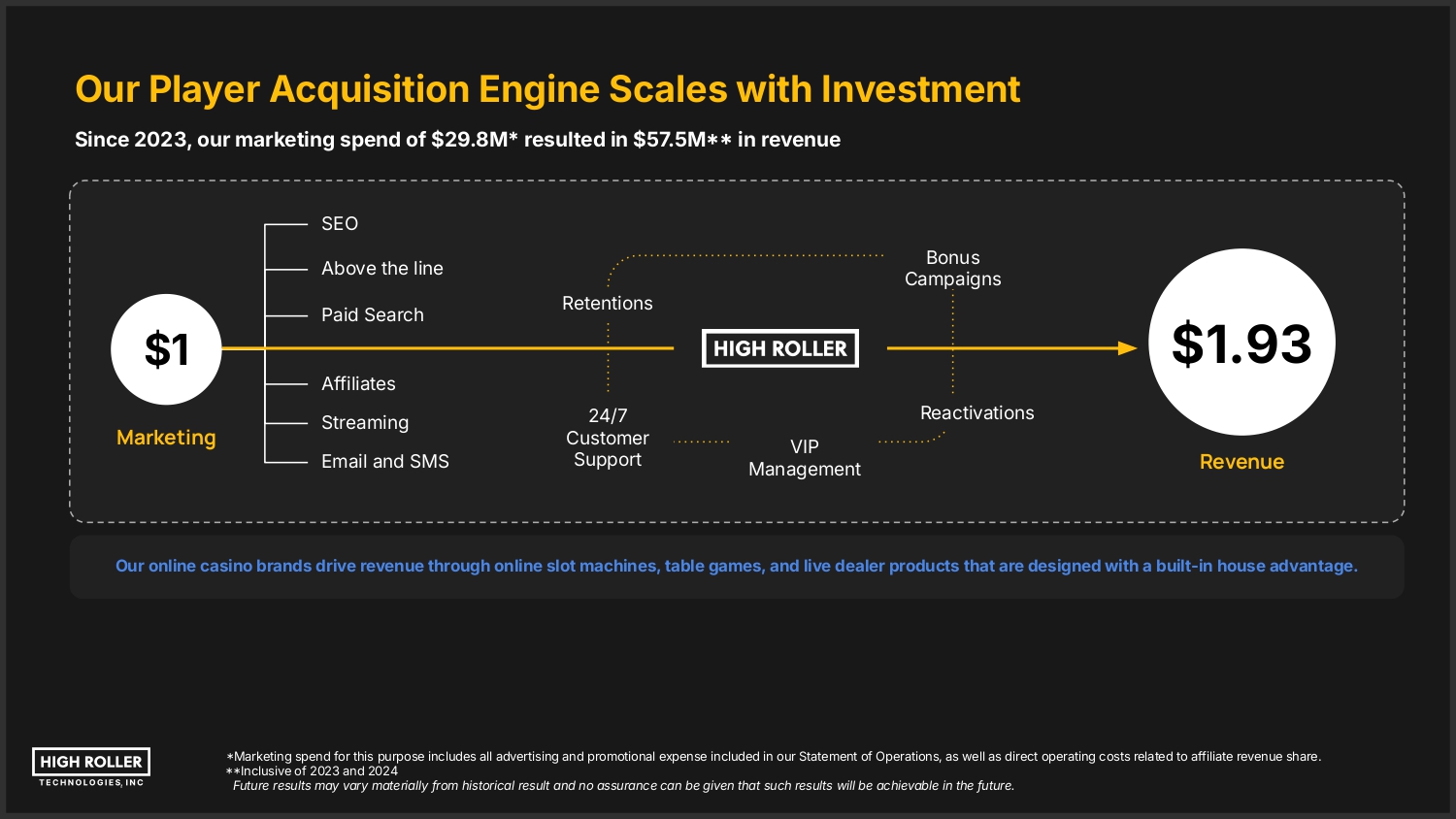

Our Player Acquisition Engine Scales with Investment Since 2023, our marketing spend of $29.8M* resulted in $57.5M in revenue SEO Bonus Campaigns Above the line $1 Marketing Paid Search Retentions $1.93 Affiliates Streaming Email and SMS 24/7 Customer Support Reactivations VIP Management Revenue Our online casino brands drive revenue through online slot machines, table games, and live dealer products that are designed with a built-in house advantage. Marketing spend for this purpose includes all advertising and promotional expense included in our Statement of Operations, as well as direct operating costs related to affiliate revenue share. Inclusive of 2023 and 2024 Future results may vary materially from historical result and no assurance can be given that such results will be achievable in the future.

Our Experienced Board Board of Directors Michael Cribari - Chairman Brandon Eachus Daniel Bradtke 17 years experience in the iGaming industry. Director and founder of global iGaming company Spike Up Media & Chairman of the Board of High Roller Technologies. 17 years experience in executive management roles. Director of Spike Up Media and a member of the High Roller technologies board of directors. 19 years experience in the iGaming industry with a proven track record of successfully founding, operating and exiting multiple global iGaming ventures. High Roller Technologies board member. Kristen Britt David Weild IV Jonas Martensson Vice President of People & Culture at Anaxi, a subsidiary of Aristocrat Gaming. Previously held leadership and management roles at Hard Rock Digital, Churchill Downs. Former Vice Chairman of NASDAQ and President of Prudential Financial. Founder, Chairman, and CEO of investment banking firm Weild Capital, LLC. Previously served on the boards of PAVmed NASDAQ PAVM, BioSig Technologies NASDAQ BSGM, Helium, and current board member of Scopus, BioPharma, INX, and Emeritus. Strategic advisor at Mojang Studios, previously serving as CEO of Mojang AB, the creators of Minecraft. Co-founder of Happy Socks and MobileBet.com. Previous board experience includes Finnair NASDAQ) and XLMedia AIM XLM.

Our Leadership Team Key Executives Ben Clemes - Chief Executive Officer 19 years experience in the iGaming industry. Co-founder of Gaming Innovation Group, serving as MD of the platform unit. Extensive experience in regulated markets and casino development. Adam Felman - Chief Financial Officer Experienced in iGaming and public markets, previously serving as CFO and Board Member of Digital Gaming Corporation, and as a Chartered Accountant ACA) at Hazlems Fenton LLP. Emily Micallef - Chief of Staff, Chief Operating Officer 10 years of experience in people operations and organizational strategy. Prior to High Roller, Emily was Head of Human Resources at Greentube Novomatic), and an investment and portfolio partner at HappyHour.io. Key Executives Seth Young - SVP Corporate Development & Investor Relations 20+ years experience in the iGaming industry as an executive, entrepreneur, board member, and investor. Experience includes PointsBet, Foxwoods, GMA Consulting, Fifth Street Gaming, Kinectify, EQL Games, & Kindbridge Behavioral Health. Sarah Stienon - Chief Legal & Compliance Officer 10+ years experience in regulated and international markets. Prior experience as CLO, COO, and MLRO at Jackpot.com and Counsel at GAMING1. Key Advisors Robin Reed - Advisor 20+ years experience in the iGaming industry, having held numerous leadership roles in private and public companies. iGaming Hall of Fame inductee in 2019. Jeff Smith - Advisor 25 years digital marketing experience, building agencies, platforms, and brands reaching hundreds of millions of users.

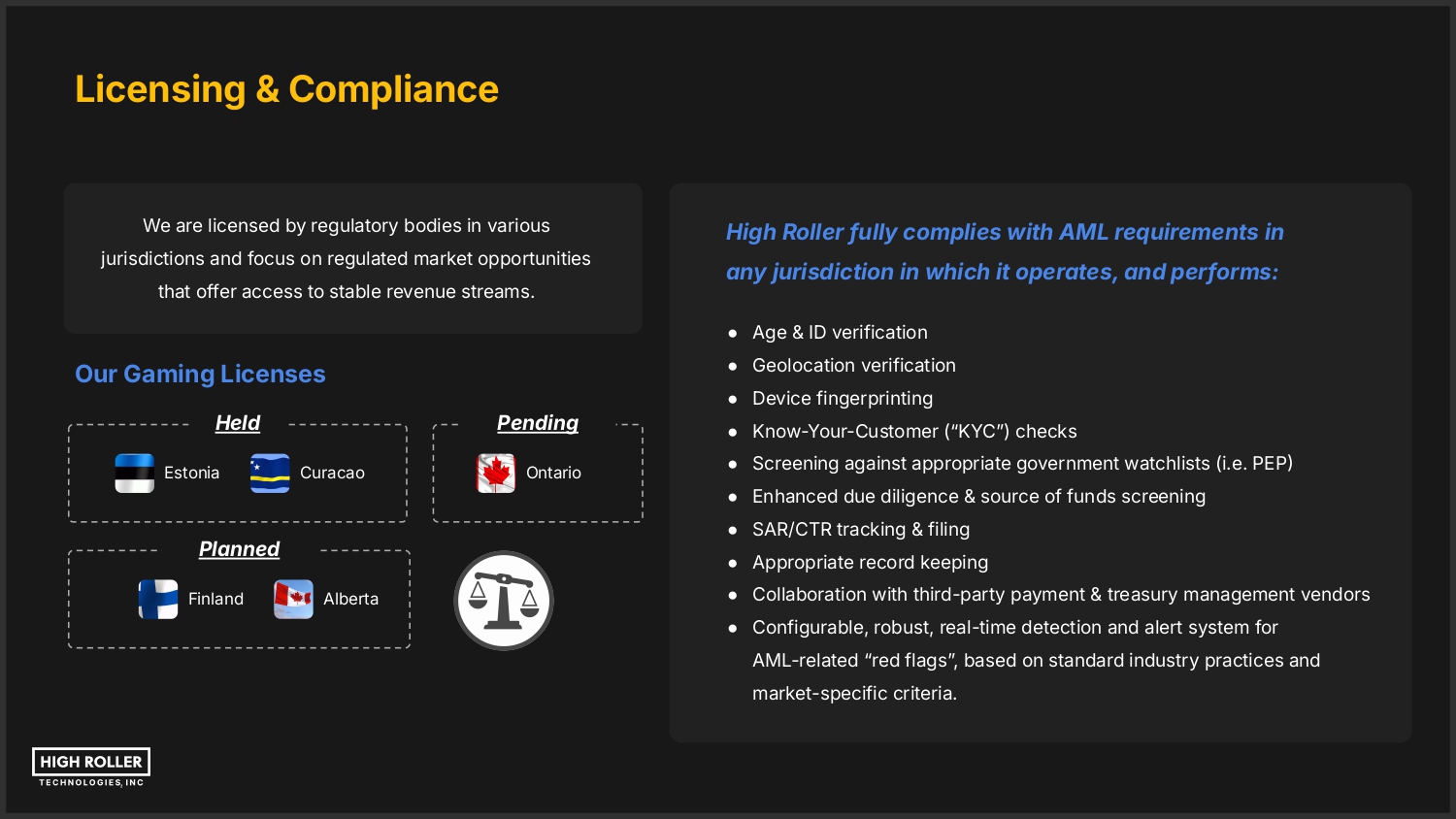

Licensing & Compliance We are licensed by regulatory bodies in various jurisdictions and focus on regulated market opportunities that offer access to stable revenue streams. High Roller fully complies with AML requirements in any jurisdiction in which it operates, and performs: ● Age & ID verification ● Geolocation verification Our Gaming Licenses Held Estonia ● Device fingerprinting Pending Curacao Ontario ● Know-Your-Customer (“KYCˮ) checks ● Screening against appropriate government watchlists (i.e. PEP ● Enhanced due diligence & source of funds screening ● SAR/CTR tracking & filing Planned Finland ● Appropriate record keeping Alberta ● Collaboration with third-party payment & treasury management vendors ● Configurable, robust, real-time detection and alert system for AML-related “red flagsˮ, based on standard industry practices and market-specific criteria.

Finland: Core Market Focus ● The online gaming total addressable market opportunity is estimated between $600M to $1.2B (regulated & unregulated) ● The management, advisory, and founding team(s) have strong experience in the Finnish market ● Subject to enabling legislation (est. June 2025, Finland will move from its current structure as government monopoly to a licensed, regulated market profile (est. January 2027 ● Finland is our largest current market, currently driving 60% of Net Gaming Revenue ● High Roller has the potential to over-index fair market share due to its localized knowledge and running start ● Licensing de-risks loss of revenue and provides ongoing business stability ● Organizational restructure contemplates greater focus on Finland ● Use of open banking reduces cost and complexity of payments & KYC, reducing overhead as compared to 2026 License applications Open for B2C 2027 Licensed operators commence operations markets of prior focus ● Potential for prohibited revenue-share based affiliation justifies increase in market spend reallocated from other markets * Source: Veikkaus Oy Annual Report, & SBC News 2028 B2B software supplier licenses required

Ontario: Core Market Focus ● Ontario entry increases our total addressable market by $2.4B.*** ● High Roller has submitted its initial license application to access the Ontario iGaming market ● Ontario is the 6th largest regulated market in the world by GGR with strong future growth expected* ● Ontario is the #1 top performing market in North America over the first 3 years of its lifetime ($5.2B April 2022-Present)** ● Online casino represents the vast majority of Ontarioʼs total addressable market opportunity (72%)*** ● Successful license procurement adds additional gaming license to company portfolio, increasing business value and reputation ● Premium, casino-focused High Roller brand will resonate with educated consumers ● SpikeUp player acquisition capabilities offer strong strategic advantage ● Regulated market entry enables company to shift existing unregulated Canadian marketing spend into regulated environment ● License approval & product launch expected H2-2025 ● Market entry is an anchor for further expansion in Canada as provinces undergo regulatory harmonization (i.e. Alberta) * ** *** Source: Vixio Source: Gaming News Canada Source: Ontario Alcohol & Gaming Commission, Market Data Reports Q1 2025 License Application Submitted H2 2025 License Approval & Launch 2026 Further Expansion

Alberta: Core Market Focus ● Analyst estimates of the total addressable online gambling revenue opportunity in Alberta vary, with market sizing estimates ranging from approximately $300M to $750M.* ● In 2025 the Alberta Provincial Legislature introduced Bill 48, the iGaming Alberta Act, to establish a framework for licensing and regulation of online gaming operators and suppliers, in the interest of creating an open and competitive market similar to Ontario. ● As of May 7, 2025, Bill 48 passed its third reading in the provincial legislature, confirmed by Royal Assent. ● The market structure and taxation rate are expected to be similar to Ontario 20%. ● Subject to approval of the provinceʼs regulatory framework, the market is projected to go live in 2026. ● Albertaʼs provincial market is highlighted by high projected player values, making the market an attractive emerging opportunity. ● Q2 2025 Enabling legislation passed H2 2025 License submission and approval Subject to licensing and regulatory approval, High Roller anticipates the opportunity to enter Albertaʼs regulated market as a licensed operator. 2026 Launch * Source: ALGC, H2 Gambling Capital, iGaming Next

Canada & Finland ● Ontario, Alberta, & Finland are mature online gaming markets with well-educated player bases, moving from unregulated to regulated ● The markets feature shared player behaviors around content preferences, and embrace use of open-banking for lower-friction transactions ● Ontarioʼs market features a favorable gaming tax and regulatory framework, with Alberta and Finland expected to follow suit. ● Strong cultural crossover supports our brand messaging and player engagement strategy ● Casino-led brands like High Roller have a track-record of success in markets typically dominated by sports-led brands ● All three markets rank amongst the highest in the world in terms of player engagement and customer value

Our Expansion Strategy to Enter Additional Regulated Markets High Roller is focused on perfecting, scaling, and maintaining operations in a measured amount of core markets, which will lead to efficient operational economies of scale as we continue brand expansion into new markets. Success in our core markets will drive our expansion strategy into new high-potential regulated markets like the United States and Latin America. Licensing Market Access Joint Venture Applying directly for a license for a specific market through the local regulatory body, like in Finland, Ontario, or Alberta. Commercial agreement with a local license holder to launch and operate an online brand, after licensing and regulatory approval, a structure featured in many jurisdictions in the United States. Partnering with a local licensed operator that has a lack of digital knowledge and/or resources, which is common with retail casinos that obtain an online license through regulation.

SpikeUp Media is Our Secret Sauce ● High Rollerʼs Founders include the founders of SpikeUp Media, who have more than 15 years of direct experience in the online casino industry, generating over 1M first-time depositing customers for its partners and more than $600M in player deposits from over $150M in advertising spend. ● SpikeUp has successfully operated across 30 international markets, attaining deep insight into successful market-entry strategies. SpikeUpʼs capabilities represent one of our keys to success in the markets in which we operate. Experts on social media ● Large, in-house creative team with a proven track record of results ● A large and continuously growing network of talent/influencers to leverage for ad creatives ● Ability to produce and deliver hundreds of ads each week targeting a vast range of demographics and segments across all social media platforms ● Extensive experience with operating large campaigns in licensed markets, and an ability to ensure that all advertisements adhere to local regulatory requirements. Data & Proprietary AI technology ● SpikeUpʼs proprietary technology provides an unfair advantage around customer acquisition relative to the efforts of other brands ● Real time targeting of high-value players while avoiding individuals that may be experiencing problems with gaming ● Features a lower cost per acquisition and a higher return on advertising spend than industry standard ● ● AI powered data and content feeds accelerate search engine optimization (“SEOˮ) efforts through the creation thousands of unique game content pages in a matter of minutes, improving competitive rankings with lower effective cost

Our Revenue is Diversified ● High Roller may choose to offer a sports betting product as an additional customer amenity to complement its leading online casino product in select markets, which is an upside opportunity CasinoRoom: B2B Affiliate Marketing ● While High Roller focuses on regulated markets, our active CasinoRoom affiliate business allows for strategic revenue diversification. ● CasinoRoom allows for the generation of revenue in markets that our casino brands may not operate in directly, expanding our reach while minimizing overhead and regulatory exposure. ● This cost-effective, low-risk revenue stream complements our core strategy and provides optionality for the future.

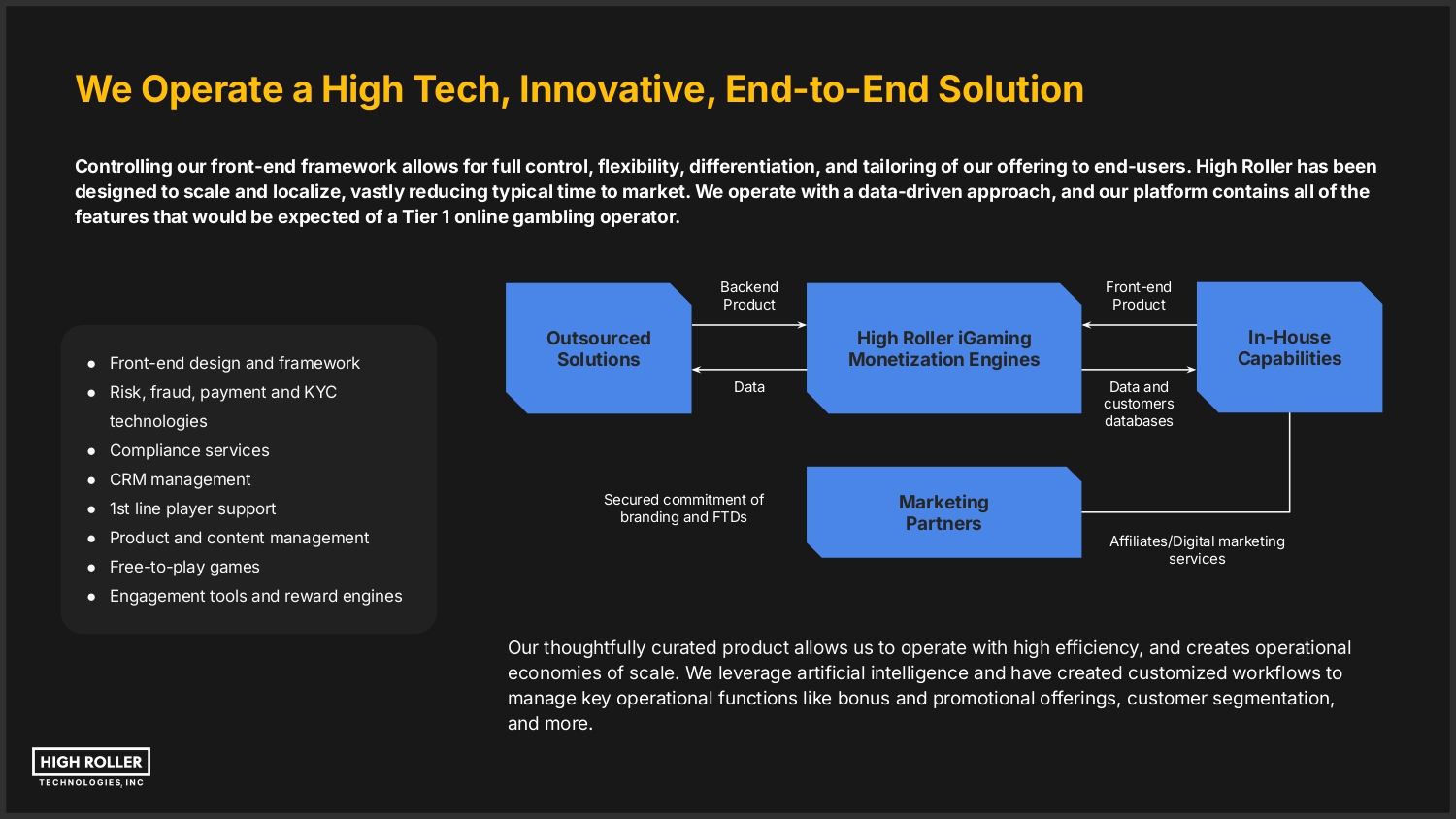

We Operate a High Tech, Innovative, End-to-End Solution Controlling our front-end framework allows for full control, flexibility, differentiation, and tailoring of our offering to end-users. High Roller has been designed to scale and localize, vastly reducing typical time to market. We operate with a data-driven approach, and our platform contains all of the features that would be expected of a Tier 1 online gambling operator. Backend Product ● Front-end design and framework ● Risk, fraud, payment and KYC Outsourced Solutions Front-end Product In-House Capabilities High Roller iGaming Monetization Engines Data Data and customers databases technologies ● Compliance services ● CRM management ● 1st line player support ● Product and content management ● Free-to-play games Secured commitment of branding and FTDs Marketing Partners Affiliates/Digital marketing services ● Engagement tools and reward engines Our thoughtfully curated product allows us to operate with high efficiency, and creates operational economies of scale. We leverage artificial intelligence and have created customized workflows to manage key operational functions like bonus and promotional offerings, customer segmentation, and more.

Reintroducing High Roller: Key Takeaways ● In a world where online gaming products are relatively commoditized, High Rollerʼs VIP branding sets it apart from the crowd. ● High Roller is a casino-led brand that may choose to offer a sports wagering product as an amenity, which sets the brand apart from sports-first brands. Historically, casino-led brands competing in sports-focused markets tend to find outsized success with casino-led consumers. ● ● High Roller is founded and operated by well-known industry veterans that remain active as early-stage investors in the gambling and entertainment market. This deep industry-side connectivity provides High Roller with a unique advantage related to introducing new, innovative products to market before other operators. Our resilient, regulation-first growth model offers stronger long-term margins, reduces business volatility, and positions our brand for global scalability. ● High Rollerʼs excellence in customer acquisition and retention is anchored by SpikeUpʼs 15+ years of experience in marketing, and its highly proprietary technology focused on executing media spend for the highest possible return on investment. ● High Roller offers over 5,000 game titles from more than 90 leading game vendors, boasting one of the largest online gaming libraries of any operator in the world. ● High Roller is focused on perfecting, scaling, and maintaining operations in a measured amount of core markets, which will lead to efficient operational economies of scale as we continue brand expansion into new markets.

More Information Q1 2025 FY 2024 Q3 2024 Investor Relations Earnings Release Earnings Release Earnings Release Our Portal 10-Q 10-K 10-Q Get Email Alerts High Roller News Premium brand value HighRoller.com is the ultimate iCasino brand, resonating to the highest value player segment Highly experienced management team Over 100 years combined experience in online gambling and development AI-Driven development Reduces operational costs through automation of key functions Strong foundation for growth Accelerating revenue growth in existing markets and through new market expansion

Thank You 2025 Contact Us | T 800-460-1039 | IR@highroller.com ir.highroller.com