Exhibit 99.1

Company Overview: Fall 2024

HIGH ROLLER TECHNOLOGIES, INC. Forward Looking Statements 2 Certain statements in this presentation constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. We make forward-looking statements in this Free Writing Prospectus that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “vision,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions. Forward-looking statements include, but are not limited to, such matters as: • our ability to manage expansion into the U.S. markets and other markets; • our ability to compete in our industry; • our expectations regarding our financial performance, including our revenue, costs, EBITDA and Adjusted EBITDA; • the sufficiency of our cash, cash equivalents, and investments to meet our liquidity needs; • our ability to mitigate and address unanticipated performance problems on our websites, or platforms; • our ability to attract, retain, and maintain good relations with our customers; • our ability to anticipate market needs or develop new or enhanced offerings and services to meet those needs; • our ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to our business both in the U.S. and internationally and our expectations regarding various laws and restrictions that relate to our business; • our ability to anticipate the effects of existing and developing laws and regulations, including with respect to taxation, and privacy and data protection that relate to our business; • our ability to obtain and maintain licenses or approvals with gambling authorities in the U.S. or in other foreign jurisdictions; • our ability to effectively manage our growth and maintain our corporate culture; • our ability to identify, recruit, and retain skilled personnel, including key members of senior management; • our ability to successfully identify, manage, consummate and integrate any existing and potential acquisitions; • our ability to maintain, protect, and enhance our intellectual property; • our intended use of the net proceeds from this offering; • our ability to manage the increased expenses associated and compliance demands with being a public company; • our ability to maintain our foreign private issuer status; and other factors detailed in our offering documents. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Each forward-looking statement speaks only as of the date of the particular statement. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained in this presentation to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. This presentation highlights basic information about us and the proposed offering. Because it is a summary, it does not contain all the information that you should consider before investing. The company has filed with the U.S. Securities and Exchange Commission (“SEC”) a registration statement including a prospectus for the offering to which this presentation relates, but such registration has not been declared effective. Before you invest you should read the prospectus in that registration statement, including the Risk Factors presented in that prospectus, and the documents incorporated therein by reference or filed as exhibits to the registration statement for more complete information about the company and this offering. You may access these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

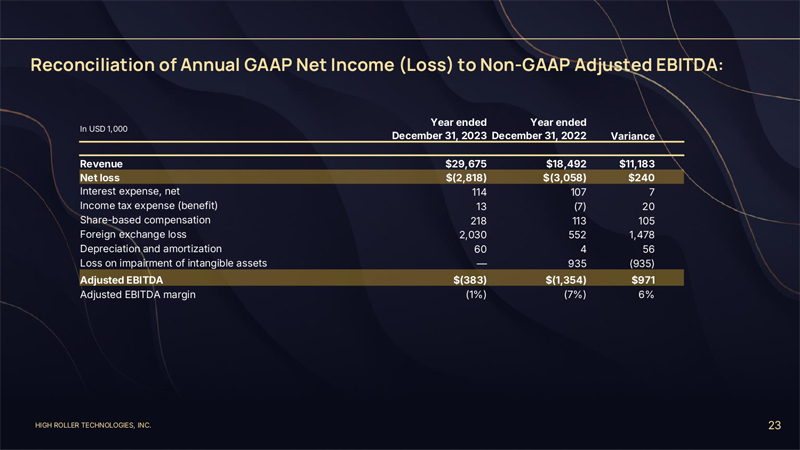

HIGH ROLLER TECHNOLOGIES, INC. Explanatory Notes on Use of Non-GAAP Financial Measures We believe “Adjusted EBITDA,” a “non-GAAP financial measure,” as such term is defined under the rules of the U.S. Securities and Exchange Commission (the “SEC”), is useful in evaluating our operating performance. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA may be helpful to investors because it provides consistency and comparability with past financial performance. However, Adjusted EBITDA is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation is provided within this Free Writing Prospectus for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business. We reconcile our non-GAAP financial measure of Adjusted EBITDA to our net income (loss), adjusted to exclude interest expense, provision for (benefit from) income taxes, share-based compensation, foreign exchange loss (gain), depreciation and amortization, impairment, and certain charges or gains resulting from non-recurring or irregular events, if any. For the years ended December 31, 2023 and 2022, as well as the 6 months ended June 31, 2024 and 2023, we did not have any such non-recurring events. 3

HIGH ROLLER TECHNOLOGIES, INC. About Us 4

HIGH ROLLER TECHNOLOGIES, INC. 5 Our vision is to lead online casino gaming by delivering one of the most immersive and engaging experiences on the planet. “ “

HIGH ROLLER TECHNOLOGIES, INC. 6 *YoY comparison is for only the year ended December 31, 2023 as compared to the year ended December 31, 2022. Interim period 2024 financial information and quarterly KPIs are presented further below within this presentation. Significant Year Over Year Growth Revenue $29.7M +60% YoY Average revenue per user $575 +11% YoY Average deposit per user $1.5K +24% YoY Unique depositors 49.8K +73% YoY Bets $714M +79% YoY Customer deposits $74.7M +114% YoY Active users 51.4K +77% YoY First time depositors 41.5K +44% YoY Financial highlights as of 12.31.2023*

HIGH ROLLER TECHNOLOGIES, INC Strong Revenue Growth Potential Through New Market Expansion Size of our existing addressable market: $3.3B* Our revenue: $29.7M** 7 Size of the world iGaming addressable market: $135B* Expansion strategy: Accelerate growth into our existing markets, investment in technology and secure market access to increase addressable market size *Data source: H2 Gambling Capital. **Year ended December 31, 2023

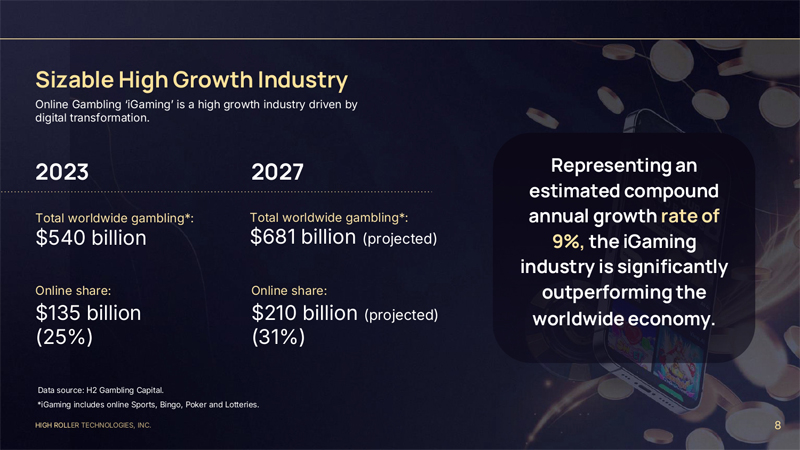

HIGH ROLLER TECHNOLOGIES, INC. 8 Sizable High Growth Industry Online Gambling ‘iGaming’ is a high growth industry driven by digital transformation. Total worldwide gambling*: $540 billion Total worldwide gambling*: $681 billion (projected) Online share: $135 billion (25%) 2023 2027 Data source: H2 Gambling Capital. *iGaming includes online Sports, Bingo, Poker and Lotteries. Online share: $210 billion (projected) (31%) Representing an estimated compound annual growth rate of 9%, the iGaming industry is significantly outperforming the worldwide economy.

HIGH ROLLER TECHNOLOGIES, INC. 9 We attracted over 25,000 players in our first yearof operation, and doubled our user basein 2023 to over 50,000 players,creating a foundation for scalable growth.

10 Launched in December 2023, Fruta.com is strategically positioned for theLatin American market, as well as broad global appeal with a memorable premium brand.

HIGH ROLLER TECHNOLOGIES, INC. 11 Our Brands areOptimized to Enjoy on All Devices

HIGH ROLLER TECHNOLOGIES, INC. 12 We Have the World’s Best Online Casino Games Over 4,400 games from more than 70 leading game providers that players know and trust

13 Live Casinois a High Growth Vertical

HIGH ROLLER TECHNOLOGIES, INC. 14 Our Marketing Expertise is our AdvantagePaid SearchTV &RadioSEOAffiliateEmail&SMSStreamingExtensive marketingexperience andkey strategic relationships provide us withaccess to high-value players in currentandfuture target markets HIGH ROLLERTECHNOLOGIES,INC.Extensive marketing experience and key strategic relationships provide us with access to high - value players in current and future target markets

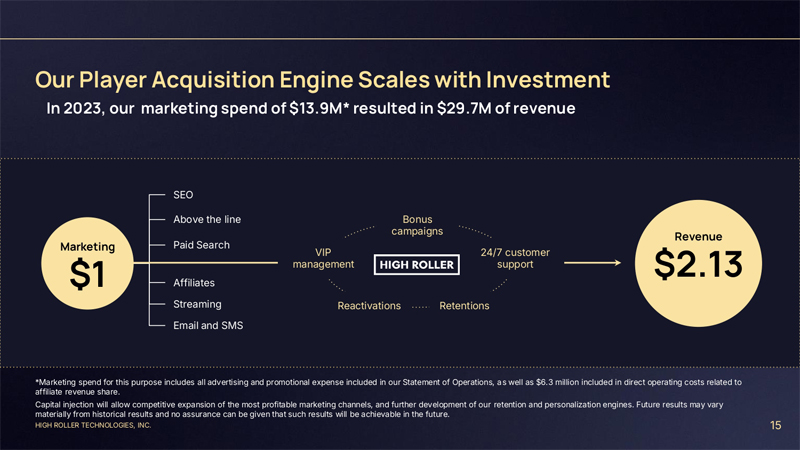

Our Player Acquisition Engine Scales with Investment In 2023, our marketing spend of $13.9M* resulted in $29.7M of revenue SEO Above the line Bonus campaigns Revenue Paid Search VIP 24/7 customer management support $2.13 Marketing $1 Affiliates Streaming Reactivations Retentions Email and SMS *Marketing spend for this purpose includes all advertising and promotional expense included in our Statement of Operations, as well as $6.3 million included in direct operating costs related to affiliate revenue share. Capital injection will allow competitive expansion of the most profitable marketing channels, and further development of our retention and personalization engines. Future results may vary materially from historical results and no assurance can be given that such results will be achievable in the future. HIGH ROLLER TECHNOLOGIES, INC. 15

End-to-End Tech Strategy Website and mobile Mobile Desktop Tablet solutions (iOS + Android) AI driven content Bonuses, promotions Operational Content, supplier and management system and segmentation automation of key lobby management functions Platform Casino content and Single source of truth Player account payment supplier database, real-time data management integrations broker Proprietary Third-Party: Pragmatic HIGH ROLLER TECHNOLOGIES, INC. 16

Primary Growth Drivers From Use of Proceeds Ramp up player acquisition, Continued investment in Expansion into new directly driving top-line technology, driving higher markets, substantially revenue growth margins and reducing time increasing our addressable to market market and revenue potential HIGH ROLLER TECHNOLOGIES, INC. 17

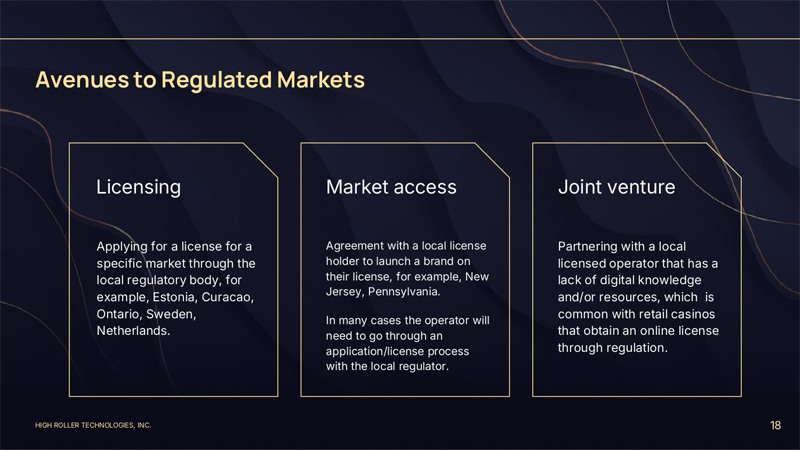

Avenues to Regulated Markets Licensing Market access Joint venture Applying for a license for a Agreement with a local license Partnering with a local specific market through the holder to launch a brand on licensed operator that has a local regulatory body, for their license, for example, New lack of digital knowledge example, Estonia, Curacao, Jersey, Pennsylvania. and/or resources, which is Ontario, Sweden, common with retail casinos In many cases the operator will Netherlands. need to go through an that obtain an online license application/license process through regulation. with the local regulator. HIGH ROLLER TECHNOLOGIES, INC. 18

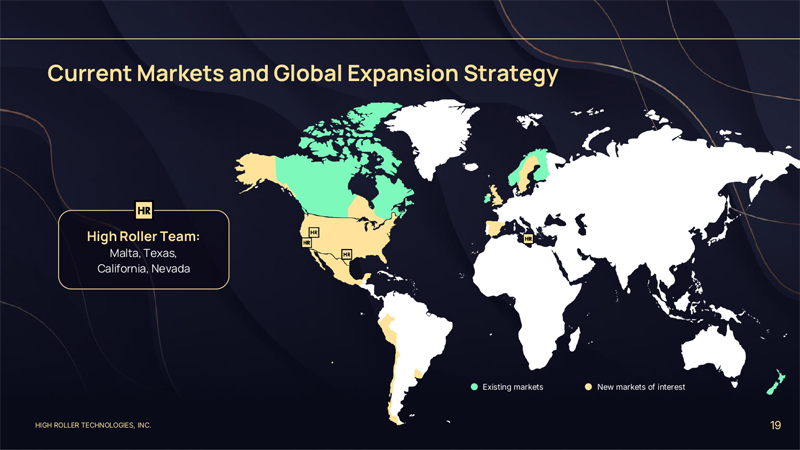

Current Markets and Global Expansion Strategy High Roller Team: Malta, Texas, California, Nevada Existing markets New markets of interest HIGH ROLLER TECHNOLOGIES, INC. 19

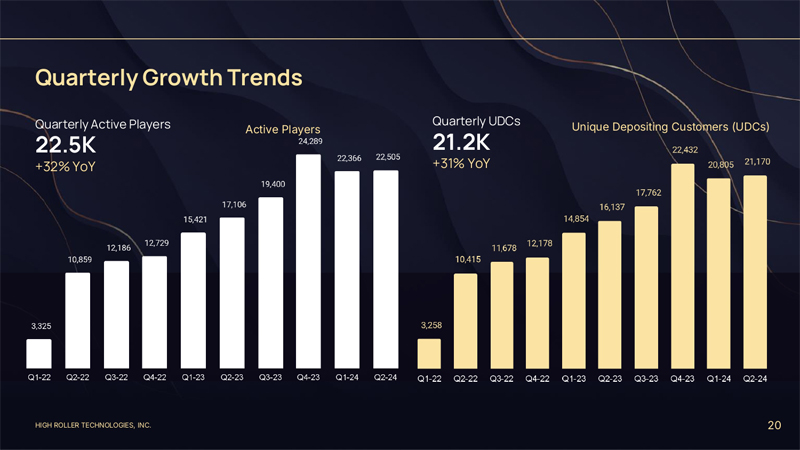

Quarterly Growth Trends Quarterly Active Players Quarterly UDCs Unique Depositing Customers (UDCs) Active Players 21.2K HIGH ROLLER TECHNOLOGIES, INC. 20

Quarterly Bets Placed (in millions) HIGH ROLLER TECHNOLOGIES, INC. 21

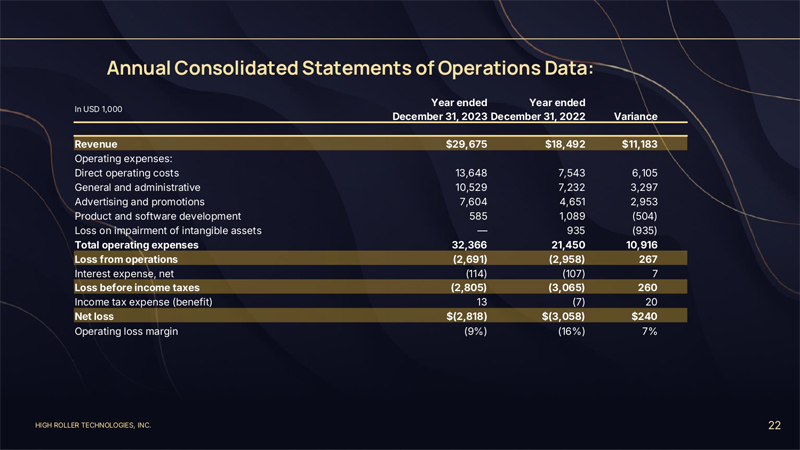

Annual Consolidated Statements of Operations Data: Year ended Year ended In USD 1,000 December 31, 2023 December 31, 2022 Variance Revenue $29,675 $18,492 $11,183 Operating expenses: Direct operating costs 13,648 7,543 6,105 General and administrative 10,529 7,232 3,297 Advertising and promotions 7,604 4,651 2,953 Product and software development 585 1,089 (504) Loss on impairment of intangible assets 935 (935) Total operating expenses 32,366 21,450 10,916 Loss from operations (2,691) (2,958) 267 Interest expense, net (114) (107) 7 Loss before income taxes (2,805) (3,065) 260 Income tax expense (benefit) 13 (7) 20 Net loss $(2,818) $(3,058) $240 Operating loss margin (9%) (16%) 7% HIGH ROLLER TECHNOLOGIES, INC. 22

Reconciliation of Annual GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA: Year ended Year ended In USD 1,000 December 31, 2023 December 31, 2022 Variance Revenue $29,675 $18,492 $11,183 Net loss $(2,818) $(3,058) $240 Interest expense, net 114 107 7 Income tax expense (benefit) 13 (7) 20 Share-based compensation 218 113 105 Foreign exchange loss 2,030 552 1,478 Depreciation and amortization 60 4 56 Loss on impairment of intangible assets 935 (935) Adjusted EBITDA $(383) $(1,354) $971 Adjusted EBITDA margin (1%) (7%) 6% HIGH ROLLER TECHNOLOGIES, INC. 23

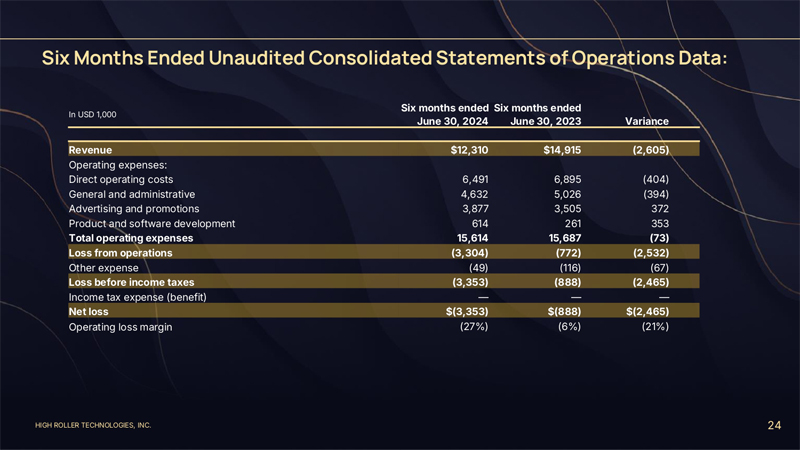

Six Months Ended Unaudited Consolidated Statements of Operations Data: Six months ended Six months ended In USD 1,000 June 30, 2024 June 30, 2023 Variance Revenue $12,310 $14,915 (2,605) Operating expenses: Direct operating costs 6,491 6,895 (404) General and administrative 4,632 5,026 (394) Advertising and promotions 3,877 3,505 372 Product and software development 614 261 353 Total operating expenses 15,614 15,687 (73) Loss from operations (3,304) (772) (2,532) Other expense (49) (116) (67) Loss before income taxes (3,353) (888) (2,465) Income tax expense (benefit) Net loss $(3,353) $(888) $(2,465) Operating loss margin (27%) (6%) (21%) HIGH ROLLER TECHNOLOGIES, INC. 24

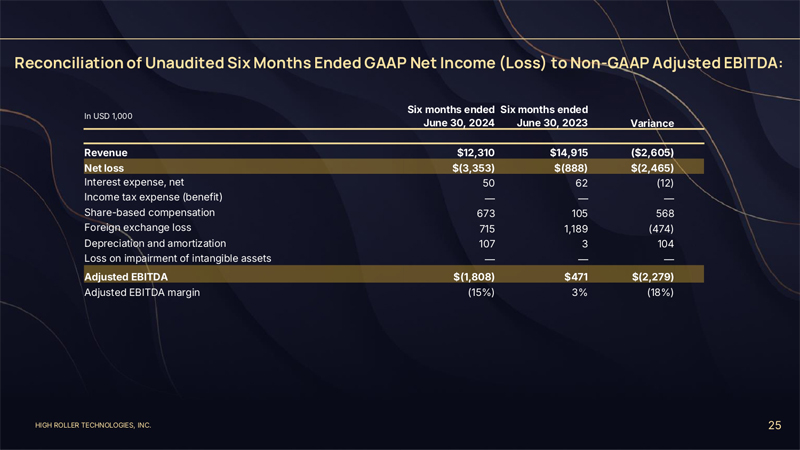

Reconciliation of Unaudited Six Months Ended GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA: Six months ended Six months ended In USD 1,000 June 30, 2024 June 30, 2023 Variance Revenue $12,310 $14,915 ($2,605) Net loss $(3,353) $(888) $(2,465) Interest expense, net 50 62 (12) Income tax expense (benefit) Share-based compensation 673 105 568 Foreign exchange loss 715 1,189 (474) Depreciation and amortization 107 3 104 Loss on impairment of intangible assets Adjusted EBITDA $(1,808) $471 $(2,279) Adjusted EBITDA margin (15%) 3% (18%) HIGH ROLLER TECHNOLOGIES, INC. 25

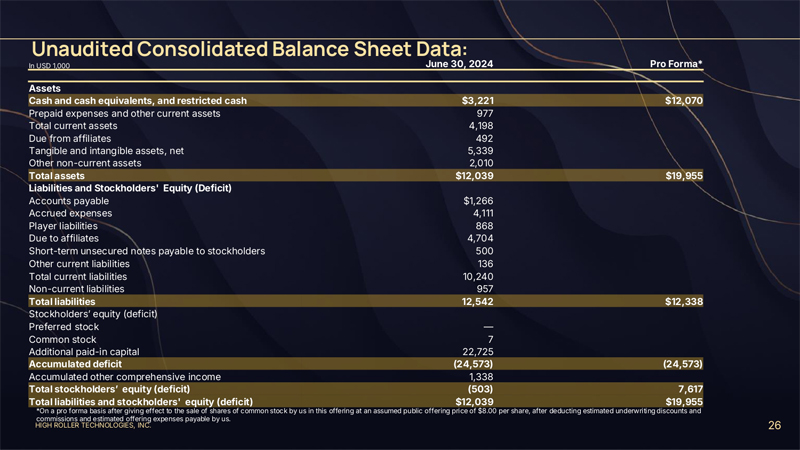

Unaudited Consolidated Balance Sheet Data: In USD 1,000 June 30, 2024 Pro Forma* Assets Cash and cash equivalents, and restricted cash $3,221 $12,070 Prepaid expenses and other current assets 977 Total current assets 4,198 Due from affiliates 492 Tangible and intangible assets, net 5,339 Other non-current assets 2,010 Total assets $12,039 $19,955 Liabilities and Stockholders’ Equity (Deficit) Accounts payable $1,266 Accrued expenses 4,111 Player liabilities 868 Due to affiliates 4,704 Short-term unsecured notes payable to stockholders 500 Other current liabilities 136 Total current liabilities 10,240 Non-current liabilities 957 Total liabilities 12,542 $12,338 Stockholders’ equity (deficit) Preferred stock Common stock 7 Additional paid-in capital 22,725 Accumulated deficit (24,573) (24,573) Accumulated other comprehensive income 1,338 Total stockholders’ equity (deficit) (503) 7,617 Total liabilities and stockholders’ equity (deficit) $12,039 $19,955 *On a pro forma basis after giving effect to the sale of shares of common stock by us in this offering at an assumed public offering price of $8.00 per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. HIGH ROLLER TECHNOLOGIES, INC. 26

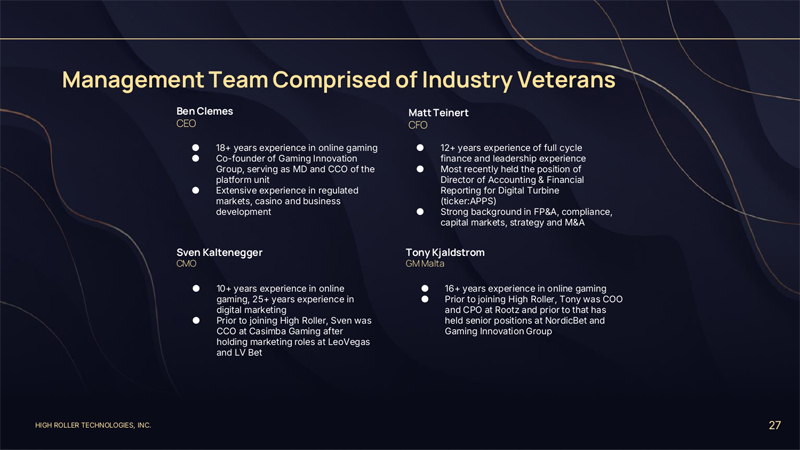

Management Team Comprised of Industry Veterans Ben Clemes Matt Teinert CEO CFO ● 18+ years experience in online gaming ● 12+ years experience of full cycle ● Co-founder of Gaming Innovation finance and leadership experience Group, serving as MD and CCO of the ● Most recently held the position of platform unit Director of Accounting & Financial ● Extensive experience in regulated Reporting for Digital Turbine markets, casino and business (ticker:APPS) development ● Strong background in FP&A, compliance, capital markets, strategy and M&A Sven Kaltenegger Tony Kjaldstrom CMO GM Malta ● 10+ years experience in online ● 16+ years experience in online gaming gaming, 25+ years experience in ● Prior to joining High Roller, Tony was COO digital marketing and CPO at Rootz and prior to that has ● Prior to joining High Roller, Sven was held senior positions at NordicBet and CCO at Casimba Gaming after Gaming Innovation Group holding marketing roles at LeoVegas and LV Bet HIGH ROLLER TECHNOLOGIES, INC. 27

Board of Directors Michael Cribari Brandon Eachus Daniel Bradtke Co-Founder, Chairman Co-Founder, Director Director ● Over 16 years of experience in investing ● Director of Spike Up Media since 2015 ● Co-Founding Partner at HappyHour.io, a VC in various European-based iGaming ● 17+ years of experience in executive dedicated to fostering the growth of emerging businesses management roles iGaming startups ● Director of global iGaming company ● Shareholder in Ellmount Interactive, ● 18 years of experience in iGaming, with a Spike Up Media for the past five years overseeing corporate proven track record in establishing and exiting and Chairman of the parent company, communications, marketing, and multiple ventures including Mobilebet.com and Ellmount Interactive AB finance divisions Suomikasino.com Kristen Britt Jonas Martensson David Weild IV Director Director Director ● Vice President of People & Culture at ● Strategic Advisor at Mojang Studios, ● Formerly vice chairman of Nasdaq and president Anaxi, a subsidiary of Aristocrat Gaming with a focus on social impact and of Prudential Financial ● Previously held leadership and partnerships ● Founder, chairman, and CEO of investment management roles at online gaming ● Served as the CEO of Mojang AB, the banking firm Weild Capital, LLC company Hard Rock Digital and horse creators of Minecraft, from 2014 to ● Previously served on the boards of PAVmed racing complex Churchill Downs 2021 (Nasdaq: PAVM), BioSig Technologies (Nasdaq: ● Co-founder of Happy Socks and BSGM), Helium and current board member of Mobilebet.com Scopus BioPharma, INX, and Emeritus ● Brings previous board experience from ● Director of charities 9-11 charity Tuesday’s Finnair (Nasdaq) and XLMedia (AIM: Children and Dignity Beyond Borders XLM) ● Recognized expert in capital markets and has spoken at the White House and before Congress HIGH ROLLER TECHNOLOGIES, INC. 28

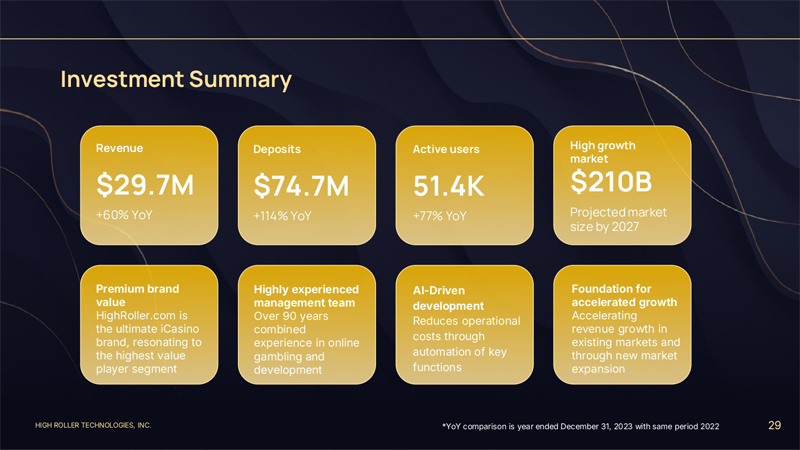

Investment Summary Revenue Deposits Active users High growth market $29.7M $74.7M 51.4K $210B +60% YoY +114% YoY +77% YoY Projected market size by 2027 Premium brand Highly experienced AI-Driven Foundation for value management team development accelerated growth HighRoller.com is Over 90 years Accelerating Reduces operational the ultimate iCasino combined revenue growth in costs through brand, resonating to experience in online existing markets and the highest value gambling and automation of key through new market player segment development functions expansion HIGH ROLLER TECHNOLOGIES, INC. *YoY comparison is year ended December 31, 2023 with same period 2022 29