As submitted confidentially to the U.S. Securities and Exchange Commission on February 15, 2023. This Amendment No. 1 to the draft registration statement has not been publicly filed with the U.S. Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

HIGH ROLLER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7900 | 87-4159815 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

400

South 4th Street, Suite 500-#390

Las Vegas, Nevada 89101

(702) 509-5244

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael

Cribari

Chief Executive Officer

High Roller Technologies, Inc.

400

South 4th Street, Suite 500-#390

Las Vegas, Nevada 89101

(702) 509-5244

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Aaron A. Grunfeld, Esq. Law Offices of Aaron A. Grunfeld & Associates 9454 Wilshire Boulevard, Suite 600 Beverly Hills, California 90212 (310) 788-7577 |

Mitchell S. Nussbaum, Esq. Norwood P. Beveridge, Esq. Lili Taheri, Esq. Loeb & Loeb LLP 345 Park Avenue New York, New York 10154 (212) 407-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Pursuant to the applicable provisions of the Fixing America’s Surface Transportation Act, we are omitting our unaudited financial statements as of and for the nine months ended September 30, 2022 and 2021 because they relate to historical periods that we believe will not be required to be included in the prospectus at the time of the contemplated offering. We intend to amend the registration statement to include all financial information required by Regulation S-X at the date of such amendment before distributing a preliminary prospectus to investors.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED _______ ___, 2023 |

Shares

Common Stock

High Roller Technologies, Inc.

This is a firm commitment initial public offering of shares of common stock of High Roller Technologies, Inc. Prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price of our shares will be between $ and $ .

We have applied to have our common stock listed on [ ] under the symbol “HRLR.” Upon completion of this offering, we believe that we will satisfy the listing requirements and expect that our common stock will be listed on [ ]. Such listing, however, is not guaranteed. If the application is not approved for listing on [ ], we will not proceed with this offering.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Excludes a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to ThinkEquity LLC, the representative of the underwriters. The registration statement, of which this prospectus is a part, also registers for sale warrants to purchase shares of common stock to be issued to the representative of the underwriters. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of our common stock, solely to cover over-allotments, if any. See “Underwriting” beginning on page 77 of this prospectus for additional information regarding underwriting compensation.

The underwriters expect to deliver the shares to purchasers on or about , 2023.

ThinkEquity

The date of this prospectus is , 2023

TABLE OF CONTENTS

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of its date.

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed.

We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Forecasts and other forward-looking information derived from such sources and included in this prospectus are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See “Special note regarding forward-looking statements.”

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the “Company,” “High Roller,” “Casino Room”, “we,” “our,” “ours,” “us” or similar terms refer to High Roller Technologies, Inc., together with its subsidiaries.

Neither we, nor any of our officers, directors, agents or representatives or underwriters, make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

The following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless the context requires otherwise, references to “we,” “us,” “our,” “High Roller,” or the “Company” refer to High Roller Technologies, Inc. and its subsidiaries.

Overview

High Roller Technologies, Inc. is a rapidly growing online gambling operator. We offer one of the most compelling real money online casino entertainment products, which we refer to as “iCasino”, to gamblers in eight countries through our HighRoller.com platform. We offer a wide range of games, including most that are available in land-based casinos, as well as many exclusively online-only games. HighRoller.com currently offers more than 2,500 games from over 40 providers, representing largely the entire range of iCasino games which we believe are most attractive to our player base including slots, craps, blackjack, roulette, baccarat, video poker and live dealer games. The HighRoller.com platform offered with this broad range of games incorporates desirable graphics, with play-inducing bonuses, interactive social media, as well as secure rapid onboarding and payouts. A number of our most popular games are available to play with a live dealer, such as blackjack, video poker, roulette, baccarat and craps. Our selections of games include those sourced from:

| ● | Evolution Gaming | |

| ● | Pragmatic Play | |

| ● | Push Gaming | |

| ● | Pragmatic Play | |

| ● | No Limit City | |

| ● | International Game Technology PLC | |

| ● | Play’nGO | |

| ● | Red Tiger Gaming | |

| ● | Big Time Gaming | |

| ● | Netent | |

| ● | Quickspin | |

| ● | Microgaming |

We believe these companies to be among the leading iCasino game providers. We generate earnings from gaming similarly to land-based casinos, through “hold”, or gross winnings, as users play against the house which maintains an edge. We deliver customized content, free-to-play, free spins, cash bonuses, an ultra-quick registration process, and fast, no-hassle payouts to our customers on a community platform that provides a safe, secure environment. We believe that we were among the early iCasino operators to integrate LiveSpins, a social casino product featuring streamers broadcasting their slot play through channels on HighRoller.com. By this feature High Roller players can enter channels and bet behind the streamer while chatting with other players and interacting with one another. The LiveSpins products on HighRoller.com have gained popularity since their introduction and have ascended to be among the top 20 on our list of most played games. We continue to explore how we can add and expand interactive social features as a unique selling point, or USP, involving the iCasino community of players

Launching Our Marquee Platform HighRoller.com

In January 2022 we launched our next-generation iCasino platform on HighRoller.com.

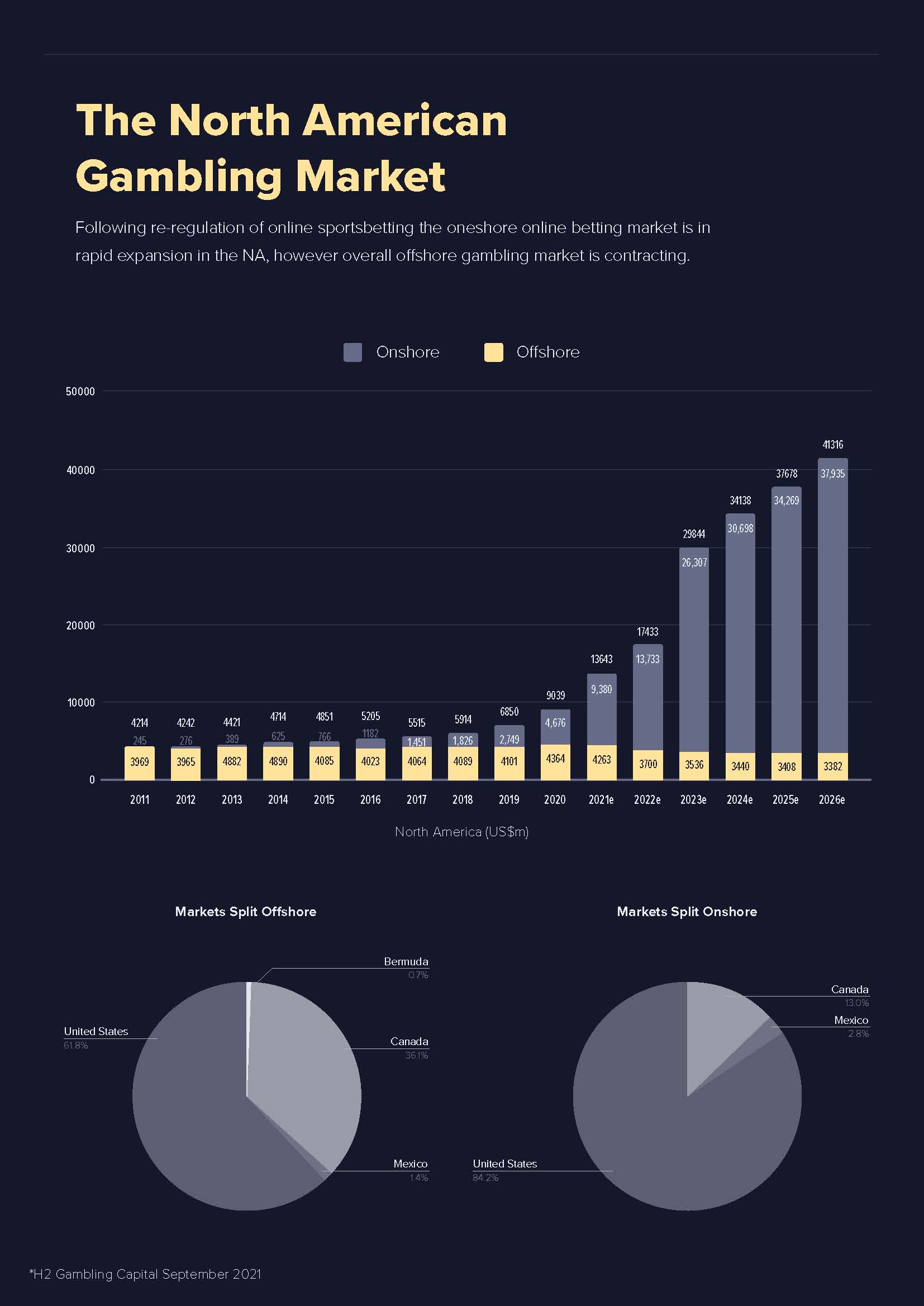

We believe HighRoller.com will provide us with enhanced value as we scale advertising and marketing efforts to new and existing markets, in particular the United States. We are duly licensed and authorized by local and remote authorities where we operate. We currently maintain licenses from Malta and Curacao and utilize an Estonian license of an affiliated company, Happy Hour Solutions Ltd.. These remote licenses provide us with access to players in Europe and in certain other international markets that include New Zealand, Canada (other than Ontario) and Southeast Asian markets such as India and Thailand. Our focus will be to enter regulated markets in North America. We plan to seek a license to operate in the Ontario, Canada market before end of Q4 2023. We intend to seek entry into one or more regulated U.S. markets utilizing proceeds from this offering but have not identified any target state or budgeted any particular amount for such entries. We currently expect that any such initial active entry to occur in approximately Q3 2024. See “Business.” ..

Our vision is “To excite the world with the most immersive real money online gaming experiences on the planet.” Our founders, board of directors, and management collectively have over 100 years of iGaming experience, having founded, listed, and exited a range of companies working in some of the most competitive global iGaming and e-commerce markets. The aim of our HighRoller.com branding and operational focus is to establish and continue to grow significant market share in the millennial segment of the US and international online casino markets.

1

We expect that our growth will be driven by attracting

and acquiring new users, engaging our existing users, re-engaging past CasinoRoom.com players, as well as entering new geographical

markets. We believe that one of our main competitive strengths stems from an established record of digital performance marketing

and operational excellence from the founding team, and recently recruited seasoned senior management.

Acquisition and Relaunch of CasinoRoom.com

Following the February 2022 acquisition of our Malta based CasinoRoom.com brand, we merged the active Casino Room player database into HighRoller.com and commenced welcoming players and VIPs onto what is in our view the superior iCasino platform.

During the six months ended June 30, 2022, we strategically relaunched CasinoRoom.com positioned as an online casino comparison portal to provide lead generation and player growth to HighRoller.com while simultaneously providing us a material additional stream of high margin revenue from casino advertisers in markets that we do not serve.

Market Trends

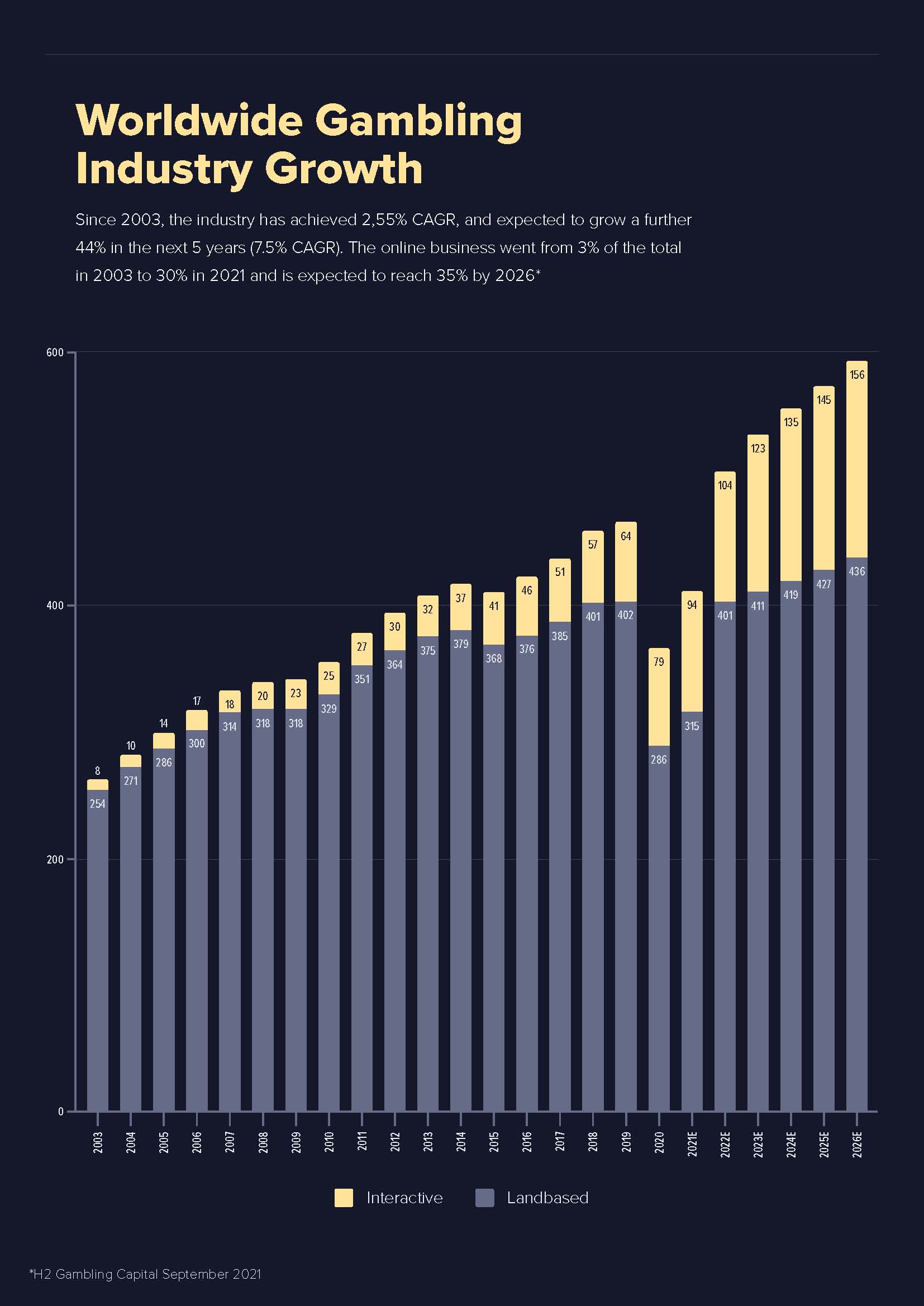

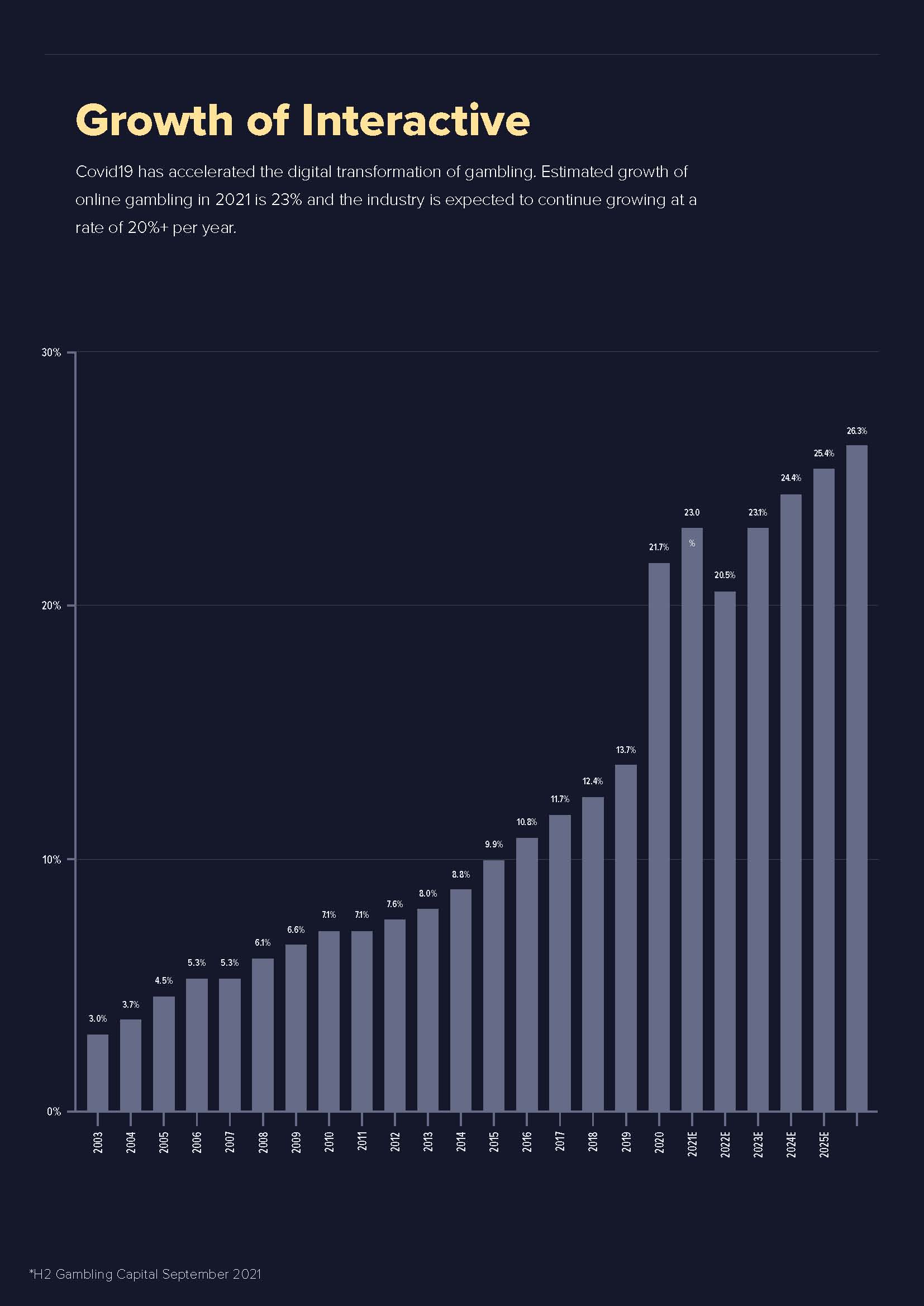

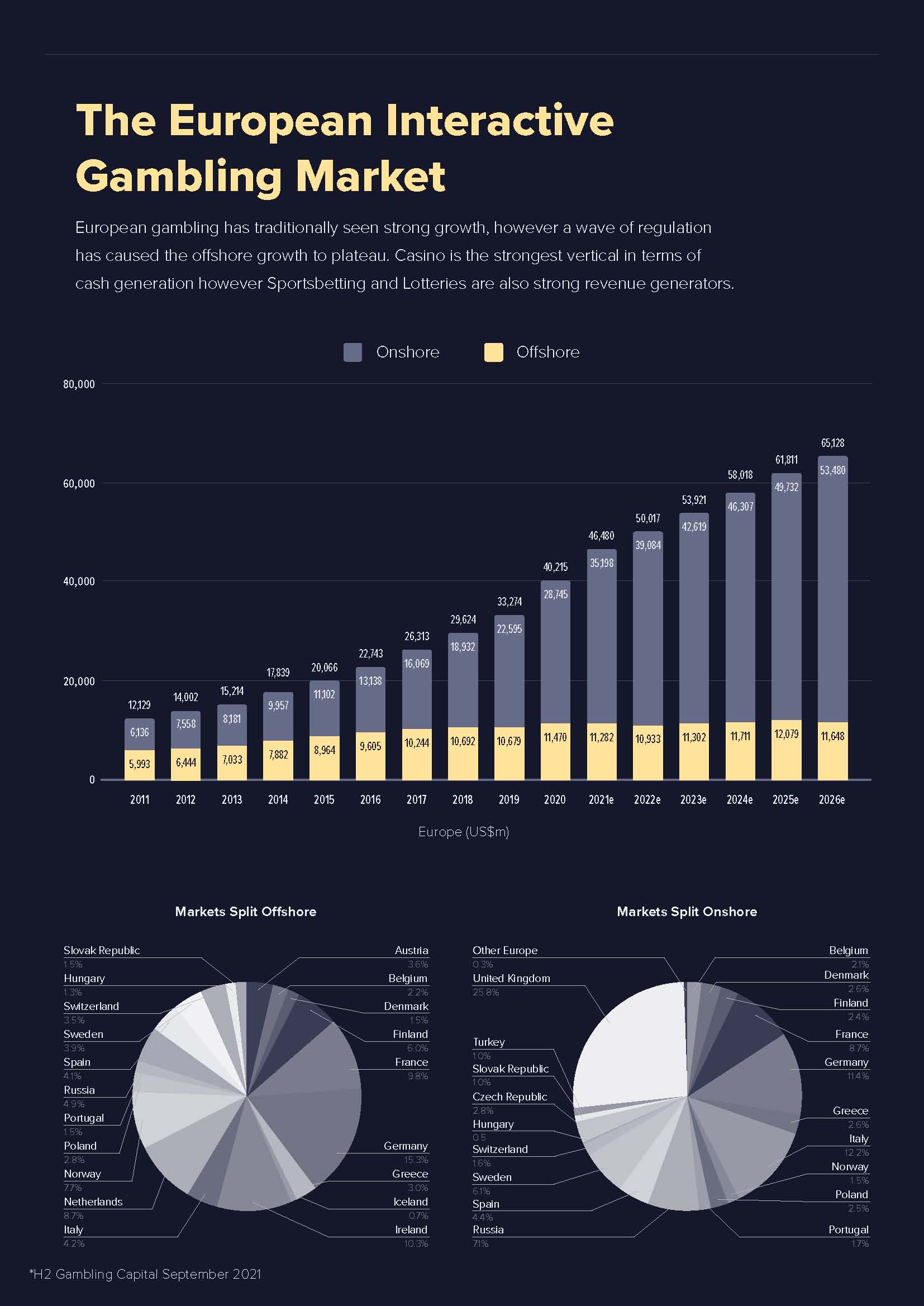

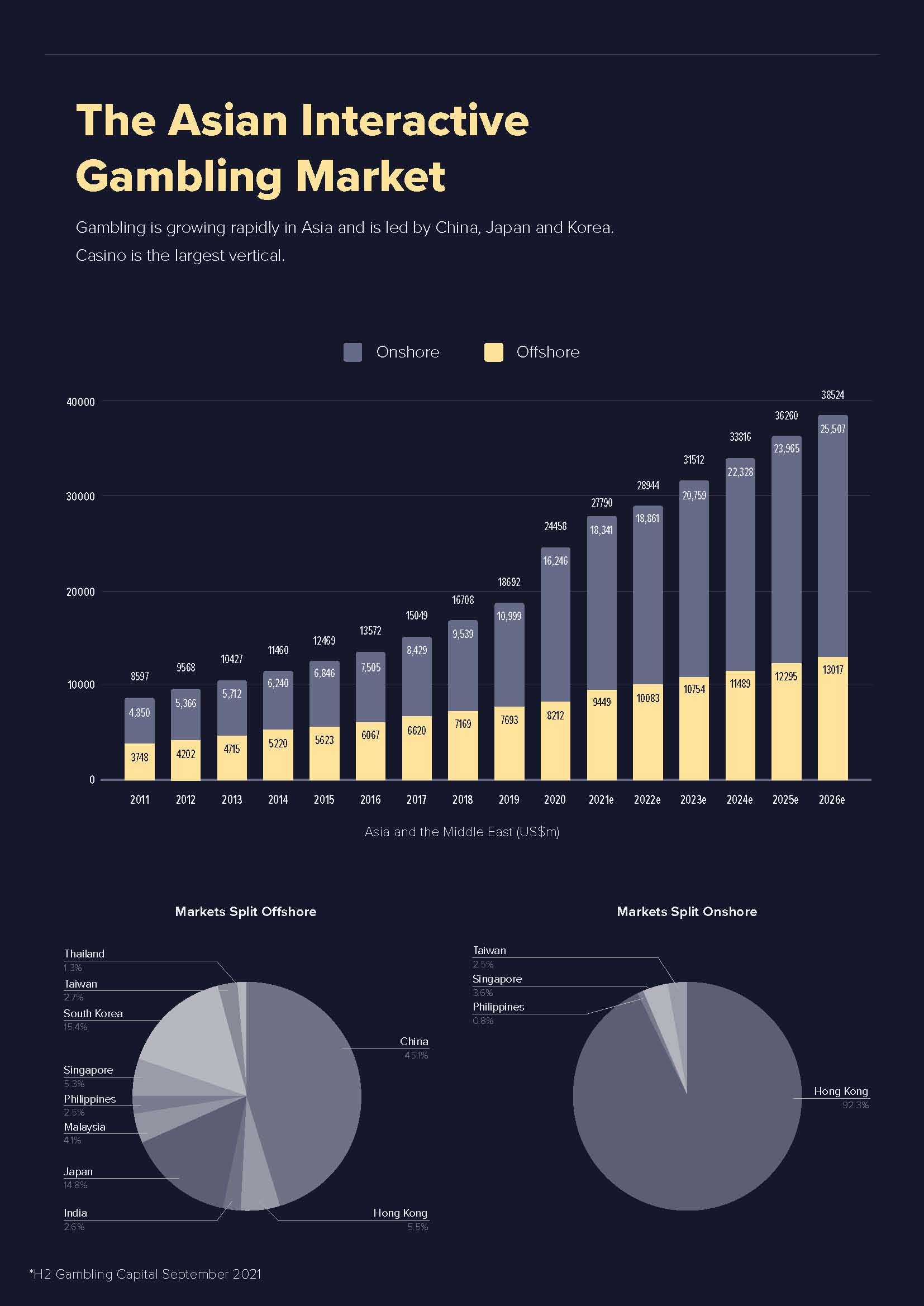

‘iGaming’ is a high growth industry driven by digital transformation with a compounding growth of approximately 7.5%. Total addressable worldwide gambling market (TAM) in 2021 is estimated to be €409 billion (bn)/ $417bn of which iGaming is €94bn/ $96bn or 22%, up from a TAM of €262bn / $267bn and €8bn/$8.2bn, respectively, in 2003. The market is expected to grow to €592bn/ $604bn by 2026, of which online gaming is expected to account for €156bn/$159bn or about 35%.

Our Business Model

We

offer our customers a wide array of attractive and exciting casino games from over 40 leading third-party game developers. Our

mission is to offer consistently superior customer experience by (i) providing fast onboarding, easy log-in and re-log-in, (ii)

assuring efficient payment processing, (iii) offering a wide variety of popular games from a wide array of leading developers,

(iv) effecting fast payouts on player winnings, (v) offering generous bonuses, bonus play and free spins on popular slots, (vi)

fostering community and interactive player involvement leading to longer stays online and more play, and (vii) maintaining live

24/7/365 customer service to assure customer satisfaction. We also have established a relationship with Spike Up Media, an affiliate

of our founders and one of the leading global providers of online lead generation to iCasino operators.

We believe that our association with Spike Up Media generates high-quality, cost-effective lead generation providing us with higher lead to customer conversions under a favorable cost structure, payment terms and revenue sharing, resulting in lower customer acquisition costs and higher gross operating margins than those from CasinoRoom.com. Approximately 78% of our acquired leads during 2022 were generated by Spike Up Media. We deem our current payment arrangements with Spike Up Media for lead generation to be favorable to us thus resulting in more rapid payback of customer acquisition costs than we might otherwise expect from leads generated by other unaffiliated providers. We expect Spike Up to adjust its arrangements with us to prevailing market terms and rates which will result in our having lower gross operating margins. If we were currently to lose the relationship with SpikeUp our iCasino operations would suffer and we could experience a material negative impact on revenue and gross profit. SpikeUp Media and the Company have operated without a written agreement but their relationship is understood according to affiliate marketing terms that are being negotiated. No assurance can be given that a formal written agreement will result or that if entered into any such agreement will be on terms as favorable as the current arrangements.

Our Growth Strategy

High Roller intends to achieve rapid, cost efficient and sustainable growth by utilizing high margin cash flow generated from online casino operations in our current international markets where we are licensed to operate and to enter and grow sustainable revenues in new markets once local regulators authorize online casino style gambling.

Our Competitive Strengths

HighRoller.com is a rapidly growing online iCasino operator of B2C brands leveraging online operational and marketing expertise and assets as the foundation of what we believe to be a highly competitive growth model. We operate in a mix of remote licensed markets (Offshore) where we may legally operate using international licenses, as well as locally licensed markets (Onshore) requiring a local license.

Offshore markets have lower thresholds to enter and higher operating margins as local regulation typically entails increased compliance requirements and higher taxation. Offshore markets however generally carry more long-term uncertainty, as emerging regulation is yet unclear. We are able to use proceeds from operations in offshore markets to invest into onshore markets building long-term sustainable profits. We historically have operated our legacy CasinoRoom.com iCasino operations in a number of offshore markets through our license from Malta. We operate our HighRoller.com iCasino operations principally through our Curacao gaming license and through a domain licensing agreement we have with Happy Hour Solutions which provides us with access to Happy Hour's Estonian gaming license. For both of these remote gaming licenses, licensors impose few territorial restrictions Territories in which iCasino may accept registrations from local residents on the basis of our Curacao license include Norway and Hungary as well as Southeast Asia. Territories in which iCasino may accept registrations from local residents on the basis of the Estonia license include New Zealand, Ireland (excluding Northern Ireland), Finland, Estonia and Canada (excluding Ontario).

We compete for customers by having optimized the HighRoller.com product for social media, including live streaming with interactive play allowing fans to bet side by side with their favorite streamers, which is industry-leading technology. We believe that through a combination of more immersive play that has built-in virality, and our focus on VIP customer experience and support, we can attract and retain large numbers of real money players and achieve Key Performance Indicators that are superior to those of our peers.

Recent Developments

We acquired 100% of HR Entertainment Ltd., a British Virgin Islands company, during the first quarter of 2022 in order to obtain the HighRoller.com domain name and related intellectual property that we believe is essential for our growth strategy. We consider this acquisition as a principal lynchpin of our ongoing strategy of delivering the most exciting and immersive real money gaming experience for the iCasino market.

We rebranded our iCasino operations from CasinoRoom.com to HighRoller.com and concurrently commenced to reposition our legacy gambling operator “CasinoRoom.com” into an online casino ratings and reviews portal that would generate high-value leads and targeted search engine traffic (SEO) for HighRoller.com and customer leads for other casinos. The new CasinoRoom.com affiliate model site further enables us to support any future brands we may launch or acquire with targeted traffic. In March 2022, we relocated our principal offices from Stockholm, Sweden to Las Vegas, Nevada, to prepare for the launch of our entry into the US markets, which we consider a strategic priority. We also established new operational office to support our various operations in the European Union.

2

Risks Associated with Our Business

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our common stock. These risks are discussed more fully in the section titled “Risk Factors” beginning on page 8 of this prospectus, and include, the following:

| ● | Competition in the online casino gaming industry is intense and, as a result, we may fail to attract and retain users who may be attracted to competing betting and gaming options, which may harm our operations and growth prospects. |

| ● | We launched our HighRoller.com domain name in January 2022 as our principal iCasino platform and have re-purposed our legacy CasinoRoom.com platform into a marketing platform that would provide lead generation to online casinos. We have no established history of operations or material financial information on which to assess our newly implemented business strategy and no assurance can be given of long-term growth and consumer acceptance in which event our future revenue and results of operations may decline. |

| ● | Our financial statements have been prepared on a going concern basis and our financial condition creates doubt as to whether we will be able to continue as a going concern. |

| ● | The success, including win or hold rates, of existing or future online wagering products depends on a variety of factors and is not completely controlled by us. |

| ● | If we fail to detect fraud or theft, including by our users and employees, our reputation may suffer, which could harm our brand and negatively impact our business, financial condition, results of operations and prospects and can result in government and civil investigations and litigations. |

| ● | Our growth prospects may suffer if we are unable to develop successful offerings or if we fail to pursue additional offerings. In addition, if we fail to make the right investment decisions in our offerings and technology platform, we may not attract and retain key users and our revenue and results of operations may decline. |

| ● | Recruitment and retention of our executives and key employees are vital to growing our business and meeting our business plans. Our inability to recruit executives or key employees, or the loss of any of our executives or other employees could harm our business. |

| ● | The nature of our business subjects us to taxation in a number of jurisdictions and changes in, or new interpretation of, tax laws, tax rulings or their application by tax authorities could result in additional tax liabilities and could materially affect our business, financial condition, results of operations and prospects. |

| ● | Our business operations are currently located outside of the United States, which subjects us to additional costs and risks that could adversely affect our operating results. |

| ● | Negative publicity or an adverse shift in public opinion regarding sports wagering or online casino wagering may adversely impact our business and user retention. |

| ● | Our business is subject to a variety of United States and foreign laws, many of which are in the process of being formulated. Any change in regulations or their interpretation, or the regulatory climate applicable to our products and services, could adversely impact our ability to operate our business, which could have a material adverse effect on our business, financial condition, results of operations and prospects. |

| ● | Our growth prospects depend on the legal status of real-money online iCasino gaming in various jurisdictions, and legalization may not occur in as many states as we expect or may occur at a slower pace than we anticipate or may be accompanied by legislative or regulatory restrictions or taxes that make it impracticable or less attractive to operate, which could adversely affect our future results of operations and make it more difficult to meet our expectations for financial performance. |

| ● | Failure to comply with regulatory requirements or to successfully obtain licenses or permits could adversely impact our ability to comply with licensing and regulatory requirements or to obtain or maintain licenses in other jurisdictions, and could cause financial institutions, online and mobile platforms and distributors to stop providing services to us. |

3

| ● | We rely on information technology and other systems and platforms, and failures, errors, defects or disruptions therein could diminish our brand and reputation, subject us to liability, disrupt our business, affect our ability to scale our technical infrastructure and adversely affect our operating results and growth prospects. |

| ● | Our product offerings and other software applications and systems, and certain third-party platforms that we use could contain undetected errors. |

| ● | Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure, other loss or theft of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, and regulatory penalties, disruption of our operations and the services we provide to users, damage to our reputation, and a loss of confidence in our products and services, each of which could adversely affect our business, financial condition, results of operations and prospects. |

| ● | We rely on third-party payment processors to process deposits and withdrawals made by our users on our platform, and if we cannot manage our relationships with these third parties and other payment-related risks, our business, financial condition, results of operations and prospects could be adversely affected. |

| ● | We rely on other third-party service and content providers and if those third parties do not perform adequately or terminate their relationships with us, our costs may increase and our business, financial condition, results of operations and prospects could be adversely affected. |

| ● | If internet and other technology-based service providers experience service interruptions, our ability to conduct our business may be impaired and our business, financial condition, results of operations and prospects could be adversely affected. |

| ● | We identified material weaknesses in our internal control over financial reporting, and we may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations. If we fail to remediate any material weaknesses or if we otherwise fail to establish and maintain effective control over financial reporting, our ability to accurately and timely report our financial results could be adversely affected. We may require additional capital to support our growth plans, and that capital may not be available on terms acceptable to us, if at all. This could hamper our growth and adversely affect our business. |

| ● | Economic downturns and political and market conditions beyond our control, including a reduction in consumer discretionary spending, could adversely affect our business, financial condition, results of operations and prospects. |

| ● | Our growth prospects and market potential will depend on our ability to obtain licenses to operate in a number of jurisdictions and to enter new markets, domestic and foreign, and if we fail to obtain these licenses our business, financial condition, results of operations and prospects could be impaired. |

| ● | The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws, which could have a materially adverse effect on our business. |

| ● | We may encounter difficulties in managing our growth, which could adversely affect our operations. |

| ● | There has been no prior public market for our common stock, the stock price of our common stock may be volatile or may decline regardless of our operating performance and you may not be able to resell your shares at or above the initial public offering price. |

Implications of Being an Emerging Growth Company and a smaller reporting company

We qualify as an “emerging growth company” under Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include not being required to:

| ● | have an independent registered public accounting firm report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board to supplement the auditor’s report by providing additional information about the audit and the financial statements (i.e., Critical Audit Matters); |

| ● | submit certain executive compensation matters to stockholder advisory votes, such as say-on-pay and say-on-frequency; and |

4

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company.

We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission (“SEC”). We may choose to take advantage of some but not all of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold investments.

We are also a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited consolidated financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

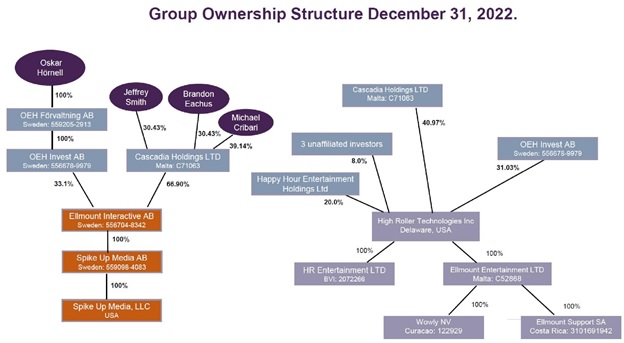

Corporate Information

High Roller Technologies, Inc. was incorporated in Delaware in December 2021. Our principal subsidiaries are (i) HR Entertainment Ltd. (organized in the British Virgin Islands), operator of our HighRoller.com platform, (ii) Ellmount Entertainment Ltd., (organized under laws of Malta), an affiliate marketer and lead generator, (iii) Wowly Ltd. (organized under laws of Curacao), a non-operating holder of our Curacao license. and (iv) Ellmount Support (based in Costa Rica) which provides customer and certain administrative support.. Our principal executive offices are located at 400 South 4th Street, Suite 500 - #390, Las Vegas, Nevada 89101. Our telephone number is (702) 509-5244.

The following chart provides our current corporate and group ownership structure and illustrates material relationships among our affiliates and principal shareholders:

Our websites are www.highroller.com and www.casinoroom.com. Information contained on our websites or connected thereto does not constitute part of this prospectus, nor is that content incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our common stock.

The functional currency of our principal operating subsidiaries is the Euro. In this prospectus we have translated the euro to the equivalent of USD$1.01, the rate quoted by the European Central Bank as of August 31, 2022.

5

| Common stock offered by us | [ ] shares. |

| Common stock to be outstanding after this offering | [ ] shares ( [__ ] shares if the underwriters exercise their option in full). |

| Underwriters’ option to purchase additional shares | We have granted the underwriters an option for a period of 45 days to purchase up to an additional shares of our common stock. |

| Use of proceeds | We estimate that net proceeds from this offering will be approximately $ million, or approximately $ million, if the underwriters exercise their over-allotment option in full, at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for costs of entering into North American markets inclusive of recruitment, costs of ongoing development of the platform, gaming licenses, computer software, marketing and advertising, as well as for general corporate and working capital purposes. We may also use a portion of the net proceeds to in-license, acquire or invest in complementary businesses or products; however, we have no current commitments or obligations to do so. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Lock-up agreements | Our executive officers and directors have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for a period of twelve months from the date of this prospectus, and all of our stockholders have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for a period of six months from the date of this prospectus. For additional information regarding our arrangement with the underwriters, see “Underwriting.” |

| Risk factors | Investment in our common stock involves substantial risks. See “Risk Factors” on page 8 and other information included in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed market symbol | “HRLR” |

The number of shares of our common stock to be outstanding after this offering is based on 25,000,001 shares of our common stock outstanding as of December 31, 2022 and excludes as of that date :

| ● | 155,000 shares of common stock issuable upon exercise of outstanding stock purchase warrants at an exercise price of $0.60 per share; | |

| ● | shares of common stock reserved for future issuance under our 2022 equity incentive plan; |

| ● | shares of common stock issuable upon exercise of outstanding stock options with a weighted average exercise price of $ ; |

| ● | shares of common stock issuable upon exercise of warrants to be issued to the representative of the underwriters as part of this offering at an exercise price of $ (assuming an initial public offering price of $ per share). |

6

Summary Consolidated Financial Data

The following tables set forth our summary consolidated financial data for the periods indicated. We have derived the summary consolidated statements of operations data and consolidated balance sheet data as of and for the years ended December 31, 2021 and 2020 from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future for any period. The following summary consolidated financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes and other information included elsewhere in this prospectus. The summary consolidated financial data included in this section is not intended to replace the consolidated financial statements and related notes included elsewhere in this prospectus.

Consolidated Statements of Operations Data:

| Years Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenue | $ | 13,445,065 | $ | 14,765,874 | ||||

| Direct operating costs | 1,513,601 | 5,526,463 | ||||||

| Product and software development | 687,745 | 453,975 | ||||||

| General and administrative (other) | 2,375,540 | 2,132,472 | ||||||

| General and administrative (related party) | 2,980,481 | 2,659,779 | ||||||

| Advertising and promotions (other) | 2,876,656 | 1,129,547 | ||||||

| Advertising and promotions (related party) | 2,010,849 | 2,599,977 | ||||||

| Total operating expenses | 12,444,872 | 14,502,213 | ||||||

| Income from operations | 1,001,193 | 263,661 | ||||||

| Interest expense, net | (2,004 | ) | (179,923 | ) | ||||

| Income tax expense | (19,743 | ) | (15,252 | ) | ||||

| Net income | $ | 978,446 | $ | 68,486 | ||||

| Net income per common share – basic and diluted | $ | 0.05 | $ | 0.00 | ||||

| Weighted average common shares outstanding – basic and diluted | 18,000,000 | 18,000,000 | ||||||

Consolidated Balance Sheet Data | ||||||||

| As of December 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash and cash equivalents, and restricted cash (current and non-current) | $ | 1,657,161 | $ | 2,003,478 | ||||

| Total assets | 4,795,500 | 9,637,676 | ||||||

| Total liabilities | 4,180,476 | 23,144,581 | ||||||

| Accumulated deficit | (15,343,781 | ) | (16,322,227 | ) | ||||

| Total stockholders’ equity (deficiency) | 615,024 | (13,506,905 | ) | |||||

7

An investment in the Company’s securities involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. The Company’s business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to it or that the Company considers immaterial as of the date of this prospectus. The trading price of the Company’s securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Unless the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to High Roller Technologies, Inc. and its subsidiaries.

Risks Related to Our Business

Competition in the retail and online iCasino industry is intense and, as a result, we may fail to attract and retain users, which may negatively impact our operations and growth prospects.

The industries in which we operate are characterized by intense competition. We compete against other providers of retail or online iCasino gaming, as well as against providers of online and mobile entertainment and leisure products more generally. Other companies producing retail or online sports wagering or online gaming and/or interactive entertainment products and services are often established and well-financed, and other well-capitalized companies may introduce competitive services. Our competitors may spend more money and time on developing and testing products and services, undertake more extensive marketing campaigns, adopt more aggressive pricing or promotional policies or otherwise develop more commercially successful products or services than ours, which could negatively impact our business. Our competitors may also develop products, features, or services that are similar to ours or that achieve greater market acceptance. Such competitors may also undertake more far-reaching and successful product development efforts or marketing campaigns or may adopt more aggressive pricing policies. Furthermore, in the future, new competitors, whether licensed or not, may enter the online iCasino gaming industries. If we are not able to maintain or improve our market share, or if our offerings do not continue to be popular, our business, financial condition, results of operations and prospects could be adversely affected.

Competitive pressures may also adversely affect our margins. For example, as we expand to become a U.S. national brand and as competition increases, we may need to increase our marketing expenses, thereby lowering our margins, in order to compete.

We operate in the global entertainment and gaming industries within the broader entertainment industry with our business-to- consumer (“B2C”), offerings such as online casino wagering, social gaming, and our B2B offerings through our Casino Room platform and other services. Our users face a vast array of entertainment choices. Other forms of entertainment, such as television, movies, sporting events and in-person casinos, are more well-established and may be perceived by our users to offer greater variety, affordability, interactivity and enjoyment. We compete with these other forms of entertainment for the discretionary time and income of our users. If we are unable to sustain sufficient interest in our online casino wagering, and social gaming platforms in comparison to other forms of entertainment, including new forms of entertainment, our business, financial condition, results of operations and prospects could be adversely affected.

In addition, our ability to achieve growth in revenue in the future will depend, in large part, upon our ability to attract new users to our offerings and retain existing users of our offerings, as well as continued user adoption of online casino and retail and online sports wagering more generally. Growth in the online casino and gaming industries and the level of demand for and market acceptance of our product offerings will be subject to a high degree of uncertainty. We cannot assure that consumer adoption of our product offerings will continue or exceed current growth rates, that the industry will achieve more widespread acceptance or that we will be able to retain our customers if we are unable to keep pace with technological innovation and customer experiences.

Our business depends on the success, including win or hold rates, of existing and future online gaming products, which rely on a variety of factors and are not completely controlled by us.

The online casino gaming industries are characterized by an element of chance. Our revenue is impacted by variations in the hold percentage (the ratio of net win to total amount wagered), or actual outcome, on the online casino games that we offer to our customers. We use the hold percentage as an indicator of an online casino game’s performance against its expected outcome. Although each online casino game generally performs within a defined statistical range of outcomes, actual outcomes may vary for any given period, particularly in the short term.

8

In the short term, for online casino wagering, the element of chance may affect win rates (hold percentages); these win rates, may also be affected in the short term by factors that are largely beyond our control, such as unanticipated event outcomes, a customer’s skill, experience and behavior, the mix of games played or wagers placed, the financial resources of customers, the volume of wagers placed and the amount of time spent gambling. For online casino games, it is possible a random number generator outcome or game will malfunction or is otherwise misprogrammed to pay out wins in excess of the game’s mathematical design and award errant prizes. Factors that are nominally within our control, such as the level of incentives or bonuses or comps given to customers, might, for various reasons both within and beyond our control, not be well- controlled and hence in turn might impact win rates. Similarly, inadvertently over-incentivizing customers can convert a casino game that would otherwise have been expected to be profitable for us into one with a positive expectation for the player.

As a result of the variability in these factors, the actual win rates on our online casino gaming offerings may differ from the theoretical win rates we have estimated and could result in the winnings of our online casino gaming customers exceeding those anticipated. The variability of win rates (hold rates) also has the potential to negatively impact our business, financial condition, results of operations, prospects and cash flows. For casino games there can be no assurance that existing casino game features will always be allowed or that new casino game features will be allowed or that regulators will not seek to constrain the operation of games in any way, for example by limiting the rate or speed of game play. If game features or other relevant aspects of casino game design are constrained then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

Our success also depends in part on our ability to anticipate and satisfy user preferences in a timely manner. As we operate in a dynamic environment characterized by rapidly changing industry and legal standards, our products are subject to changing consumer preferences that cannot be predicted with certainty. We need to continually introduce new offerings and identify future product offerings that complement our existing platforms, respond to our users’ needs and improve and enhance our existing platforms to maintain or increase our user engagement and growth of our business. We may not be able to compete effectively unless our product selection keeps up with trends in the digital sports entertainment and gaming industries in which we compete, or trends in new gaming products.

Our forecasts, including for revenues, market share, expenses and profitability, are subject to significant risks, assumptions, estimates and uncertainties and may therefore differ materially from our expectations.

We operate in rapidly changing and competitive industries, and our forecasts are subject to the risks and assumptions made by management with respect to our industries. Operating results are difficult to forecast because they generally depend on our assessment of the timing of adoption of future legislation and regulations by different states and countries, which are uncertain. Furthermore, if we invest in the development of new products or distribution channels that do not achieve significant commercial success, whether because of competition or otherwise, we may not recover the often substantial “up front” costs of developing and marketing those products and distribution channels or recover the opportunity cost of diverting management and financial resources away from other products or distribution channels.

Additionally, as described below under “— Economic downturns and political and market conditions beyond our control, including a reduction in consumer discretionary spending, could adversely affect our business, financial condition, results of operations and prospects,” our business may be affected by reductions in consumer spending from time to time as a result of a number of factors which may be difficult to predict. Moreover, while casino operations are largely unaffected by seasonality in aggregate as online casino gaming is largely an individual activity unaffected by external calendars we believe that there is however some evidence that seasonality effects may occur at the time of certain major national holidays and/or vacation periods, as a result of which our revenue and cash flows could be adversely affected during times of the year when customers are more likely to engage in other non-gaming activities. This may result in decreased revenue levels, and we may be unable to adopt measures in a timely manner to compensate for any unexpected shortfall in income. This inability could cause our operating results in a given quarter to be higher or lower than expected. If actual results differ from our estimates, analysts may negatively react and our stock price could be materially impacted.

9

Our financial statements have

been prepared on a going concern basis and our financial condition creates doubt as to whether we will be able to continue as

a going concern.

Our financial statements have been prepared on a going concern basis under which an entity is considered to be able to realize its assets and satisfy its liabilities in the ordinary course of business. Our future operations are dependent upon achieving profitable operations in the future and completing a successful equity or debt financing. No assurance can be given that we will be successful in completing an equity or debt financing or in achieving or maintaining profitability. The accompanying consolidated financial statements do not give effect to any adjustments relating to the carrying values and classification of assets and liabilities that would be necessary should we be unable to continue as a going concern.

Since the launch of the High Roller domain name in January 2022 as our principal iCasino platform we have re- purposed our legacy Casino Room platform into a marketing platform that would provide lead generation to our gaming operations. Accordingly, investors have no established history of operations or material financial information on which to assess our newly implemented business strategy and no assurance can be given of long term growth and consumer acceptance in which event our future revenue and operating margins could decline.

Our business strategy relating to the launch and expansion of our High Roller domain makes a number of assumptions about the current and future state of the industry that we operate in, including but not limited to environmental factors such as the current and future state of the markets and economies that we operate in, the current and expected future actions of governments around the world, the current and future capacity and effectiveness of our competitors, and the current and future desires and wants and means of our customers. Our strategy also makes assumptions about the current and future state of our own business, including our capacity and effectiveness to launch this brand, maintain customer interest and our ability to respond to all of the aforementioned environmental factors, amongst others. All of these assumptions are informed by data and information that is publicly available and which we gather for ourselves and by our ability to process and understand such data and information. Any or all of our assumptions may prove to be faulty and/or our data and/or information may be inaccurate or incomplete, in which case our strategy may prove to be incorrect or inadequate for the demands of our industry. Even if our strategy is a good one, we cannot be certain that our business is equipped to execute the plans and actions that might be necessary to achieve success. If any of our assumptions are incorrect and/or our strategy is poor and/or we are unable to execute on our strategy then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

Our operating results may vary, which may make future results difficult to predict with certainty.

In the past, our financial results have varied on a quarter-by-quarter basis and may continue to do so in the future. This variance is due to a variety of factors certain of which are beyond our control. Our financial results in any given quarter may be influenced by, among other things, consumer engagement and wagering results, and other factors which are outside of our control or we cannot predict.

Our financial results are dependent, in part, on continued consumer engagement. Our consumer engagement in our online casino wagering services may vary or decrease, potentially resulting in a negative impact on our business, operations, financial condition or prospects, on account of, among other factors, the user’s level of satisfaction with our platforms, our ability to improve, innovate and adapt our platform, outages and disruptions of online services, the offerings of our competitors, our marketing and advertising efforts, or declines in consumer activity generally as a result of, among other things, public sentiment or economic downturns.

Additionally, our quarterly financial results may also be impacted on the number and amount of operator losses and jackpot payouts we may experience. Though operator losses are limited per stake to a maximum payout in our online casino wagering product offering, when looking at wagers across a period of time, these losses can potentially be significant. Our quarterly financial results are also subject to any jackpot payouts made in a particular quarter.

If we fail to detect fraud or theft, including by our users and employees, our reputation may suffer, which could harm our brand and reputation and negatively impact our business, financial condition, results of operations and prospects and can subject us to investigations and litigation.

We may incur, losses from various types of financial fraud, including use of stolen or fraudulent credit card data, claims of unauthorized payments by a user and attempted payments by users with insufficient funds. Bad actors use increasingly sophisticated methods to engage in illegal activities involving personal information, such as unauthorized use of another person’s identity, account information or payment information and unauthorized acquisition or use of credit or debit card details, bank account information and mobile phone numbers and accounts. Under current credit card practices, we may be liable for use of funds on our platform with fraudulent credit card data, even if the associated financial institution approved the credit card transaction.

Acts of fraud or other forms of cheating by our gaming customers may involve various tactics, including collusion with our employees and the exploitation of loopholes in our promotional bonus schemes. Successful exploitation of our systems could have negative effects on our product offerings, services and user experience and could harm our reputation. Additionally, we may inadvertently send overly generous promotional schemes that users or regulators force us to honor. Failure to discover such acts or schemes in a timely manner could result in harm to our operations. In addition, negative publicity related to such schemes could have an adverse effect on our reputation, potentially causing a material adverse effect on our business, financial condition, results of operations and prospects. In the event of the occurrence of any such issues with our existing platform or product offerings, substantial engineering and marketing resources and management attention, may be diverted from other projects to correct these issues, which may delay other projects and the achievement of our strategic objectives.

10

In addition, any misappropriation of, or access to, users’ or other proprietary information or other breach of our information security could result in legal claims or legal proceedings, including regulatory investigations and actions, or liability for failure to comply with privacy and information security laws, including for failure to protect personal information or for misusing personal information, which could disrupt our operations, force us to modify our business practices, damage our reputation and expose us to claims from our users, regulators, employees and other persons, any of which could have an adverse effect on our business, financial condition, results of operations and prospects.

Despite measures we have taken to detect and reduce the occurrence of fraudulent or other malicious activity on our platform, we cannot guarantee that any of our measures will be effective or will scale efficiently with our business. Our failure to adequately detect or prevent fraudulent transactions could harm our reputation or brand, result in litigation or regulatory action and lead to expenses that could adversely affect our business, financial condition, results of operations and prospects.

Our current and projected performance relies upon high-bandwidth data capabilities and disruptions in the availability of these may negatively impact our business, financial conditions, results of operations and prospects.

Our products require high-bandwidth data capabilities for placement of time-sensitive wagers. If high-bandwidth capabilities do not continue to grow or grow more slowly than generally anticipated, particularly for mobile devices, our user growth, retention, and engagement may be negatively impacted. In addition, the adoption of any laws or regulations that adversely affect the growth, popularity, or use of the Internet, including laws governing Internet neutrality, could decrease the demand for our products and increase our cost of doing business. Specifically, any laws that would allow Internet providers in the United States to impede access to content, or otherwise discriminate against content providers like us over their data networks, could have a material adverse effect on our business, financial condition, results of operations, and prospects.

Additionally, if any of the third-party platforms used for distribution of our product offerings were to limit or disallow advertising on their platforms for whatever reason or technologies are developed that block the display of our ads, our ability to generate revenue could be negatively impacted. These changes could materially impact our business activities and practices, and if we or our advertising partners are unable to timely and effectively adjust to those changes, there could be an adverse effect on our business, financial condition, results of operations and prospects.

We rely on third-party service providers such as (i) providers to validate the identity and identify the location of our customers, (ii) payment processors to process deposits and withdrawals made by our customers into our platforms, (iii) marketing and customer communications systems providers, (iv) casino content, product and technology providers, and (v) other outsourced services providers, among others. If our third-party providers do not perform adequately or terminate their relationships with us, our costs may increase and our business, financial condition and results of operations could be adversely affected.

There is no guarantee that the third-party geolocation and identity verification systems that we rely on will perform adequately or will be effective. We rely on our geolocation and identity verification systems to ensure that we are in compliance with certain laws and regulations, and any service disruption to those systems would prohibit us from operating our platform and would adversely affect our business. Additionally, incorrect or misleading geolocation and identity verification data with respect to our current or potential customers received from third-party service providers may result in us inadvertently allowing access to our offerings to individuals who should not be permitted to access them, or otherwise inadvertently deny access to individuals who should be able to access our offerings, in each case based on inaccurate identity or geographic location determination. Our third-party geolocation service providers rely on their ability to obtain information necessary to determine geolocation from mobile devices, operating systems, and other sources. Changes, disruptions or temporary or permanent failure to access such sources by our third-party service providers may result in their inability to accurately determine the location of our customers. Moreover, our inability to maintain our existing contracts with third-party service providers, or to replace them with equivalent third parties, may result in our inability to access geolocation and identity verification data necessary for our day-to-day operations. If any of these risks materializes, we may be subject to disciplinary action, fines, lawsuits, and our business, financial condition, results of operations and prospects could be adversely affected.

11

We also rely on a limited number of third-party payment processors to process deposits and withdrawals made by our customers into our platform. If any of our third-party payment processors terminates its relationship with us or refuses to renew its agreement with us on commercially reasonable terms, we would need to find an alternate payment processor, and may not be able to secure similar terms or replace such payment processor in an acceptable time frame. Further, the software and services provided by our third-party payment processors may not meet our expectations, contain errors or vulnerabilities, be compromised or experience outages. Any of these risks could cause us to lose our ability to accept online payments or other payment transactions or make timely payments to customers on our platform, any of which could make our platform less trustworthy and convenient and adversely affect our ability to attract and retain our customers.

All of our payments are made by credit card, debit card or through other third-party payment services, which subjects us to certain regulations and to the risk of fraud. We may in the future offer new payment options to customers that may be subject to additional regulations and risks and/or may incur higher transaction charges. We are also subject to a number of other laws and regulations relating to the payments we accept from our customers, including with respect to money laundering, money transfers, privacy and information security. Although we have implemented processes and have dedicated teams to ensure compliance with applicable rules and regulations, there have in the past, and there may be in the future, incidences where certain relevant information relating to “know your customer” (“KYC”) and/or anti-money laundering (“AML”) is not detected or established. If we fail to comply with applicable rules and regulations, we may be subject to civil or criminal penalties, fines and/or higher transaction fees and may lose our ability to accept online payments or other payment card transactions, which could make our offerings less convenient and attractive to our customers. If any of these events were to occur, our business, financial condition, results of operations and prospects could be adversely affected.

For example, if we are deemed to be a money transmitter as defined by applicable regulation, we could be subject to certain laws, rules and regulations enforced by multiple authorities and governing bodies in the United States and numerous state and local agencies who may define money transmitter differently. For example, certain U.S. states may have a more expansive view of who qualifies as a money transmitter. Additionally, we could be subject to additional laws, rules and regulations related to the provision of payments and financial services, and if we expand into new jurisdictions, the various regulations and regulators governing our business that we are subject to will expand as well. In addition to fines, penalties for failing to comply with applicable rules and regulations could include criminal and civil proceedings, forfeiture of significant assets or other enforcement actions. We could also be required to make changes to our business practices or compliance programs as a result of regulatory scrutiny.

Additionally, our payment processors require us to comply with payment card network operating rules, which are set and interpreted by the payment card networks. The payment card networks could adopt new operating rules or interpret or reinterpret existing rules in ways that might prohibit us from providing certain offerings to some customers, be costly to implement or difficult to follow. We have agreed to reimburse our payment processors for fines they are assessed by payment card networks if we or the customers on our platform violate these rules. Any of the foregoing risks could adversely affect our regulatory licensure, business, financial condition, results of operations and prospects.

Additionally, outages in our connectivity with our payment processors or their connectivity with downstream processors and networks might inhibit our ability to successfully process deposits and withdrawals on behalf of our customers. Errors in any of these systems may cause transactions to be processed multiple times or not at all, which may in turn result in customers being overcharged, overpaid or not paying us. Overcharging customers might result in representations, returns or chargebacks which might in turn jeopardize our relationships with our payment processors and potentially lead to fines and additional transaction costs or even the termination of our relationships with our payment processors. If we do not detect these errors timely then we might over-credit to or under-deduct from our customers’ casino accounts which might in turn result in customers being inadvertently given risk-free opportunities to gamble and thereby potentially win even larger amounts. We cannot guarantee that we will detect such outages or errors timeously nor that we will be able to recover any resulting losses from customers or third-party providers. Any attempts by us to recover such losses from our customers may cause our customers to have a negative experience and our brand or reputation may be negatively affected and our customers may be less inclined to continue or resume utilizing our products or recommend our platform to other potential customers. As such, any such outages or errors could harm our reputation, business, financial condition, results of operations, cash flows and prospects.

12

Furthermore, if any of our payment processors terminates its relationship with us or refuses to renew its agreement with us on commercially reasonable terms, we might need to find an alternate provider. Given the occasionally unique benefits and features of different payment options, exact replacement might not be possible and we may not be able to secure similar terms or benefits or features or replace such payment processors in an acceptable time frame. Any of these risks could increase our costs and adversely affect our business, financial condition, results of operations or prospects. Further, any negative publicity related to any of our payment processors, including any publicity related to regulatory concerns, could adversely affect our reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

We rely on third-party service providers for components of our marketing and customer communications processes and systems. Failures or outages in these systems may inhibit our ability to acquire new customers or retain existing customers. The nature of these processes means that certain customer personal information may be transmitted through these systems. If these systems are compromised in any way then customer personal data might be compromised and in turn our customers’ perception of our reliability and security might be impacted. Any of the foregoing risks could adversely affect our business, financial condition, results of operations and prospects.

We rely on third-party providers for nearly all of our casino games. These third parties are responsible for the design, development and maintenance of these games. In the past there have been outages during which time one or more games have been unavailable. There have also been incidents where errors in the design or development or maintenance of these games has result in erroneous payouts to customers, including instances where games have erroneously produced positive expected returns to customers and hence losses for the casino. We cannot be certain that we will always detect such outages and errors timeously nor that we will be able to recover any losses resulting from errors either from customers or third-party providers. Any outages or attempts by us to recover such losses from errors from our customers may cause our customers to have a negative experience and our brand or reputation may be negatively affected and our customers may be less inclined to continue or resume utilizing our products or recommend our platform to other potential customers. As such, any such outages and errors could harm our reputation, business and operating results.

Furthermore, if any of our casino game suppliers terminates its relationship with us or refuses to renew its agreement with us on commercially reasonable terms, we might need to find an alternate provider. Given the unique design of each casino game, exact replacement would not be possible and we may not be able to secure similar terms or product features or extent of product range or replace such providers in an acceptable time frame. Any of these risks could increase our costs and adversely affect our business, financial condition, results of operations or prospects. Further, any negative publicity related to any of our third-party casino game supplier partners, including any publicity related to regulatory concerns, could adversely affect our reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

We may have difficulty accessing the services of banks, credit card issuers and payment processing services providers due to the nature of our business, which may make it difficult to sell our products and offerings.

Although financial institutions and payment processors are permitted to provide services to us and others in our industry, banks, credit card issuers and payment processing service providers may be hesitant to offer banking and payment processing services to real money gaming and online sports betting businesses. Consequently, businesses involved in our industry, including our own, may encounter difficulties in establishing and maintaining banking and payment processing relationships with a full scope of services and generating market rate interest. Similarly, our customers’ banks and/or credit card providers might decline to allow our customers to effect transactions with online gaming or sports betting businesses or might block such attempted transactions. If we are unable to maintain our bank accounts or our customers are unable to use their credit cards, bank accounts or e-wallets to make deposits and withdrawals from our platforms, it would be difficult for us to operate our business and increase our operating costs, and would pose additional operational, logistical and security challenges which could result in an inability to implement our business plan and harm our business, financial condition, results of operations and prospects.

13

Our growth prospects may suffer if we are unable to develop successful offerings or if we fail to pursue additional offerings. In addition, if we fail to make the right investment decisions in our offerings and technology platform, we may not attract and retain key users and our revenue and results of operations may decline.

Ellmount Entertainment Ltd, was founded over a decade ago, under the laws of Malta, and we have primarily focused our efforts since then on growing our current iGaming product offerings. We have repurposed Ellmount Entertainment into a marketing company and, since the first quarter 2022, and have transitioned existing customers to our recently launched High Roller.com domain. We are rapidly expanding the growth rate of that domain, and we anticipate expanding further as new product offerings mature and as we pursue our growth strategies. The industries in which we operate are characterized by rapid technological change, evolving industry standards, frequent new product offering introductions and changes in customer demands, expectations and regulations. To keep pace with the technological developments, achieve product acceptance and remain relevant to users, we will need to continue developing new and upgraded functionality of our products and services and adapt to new business environments and competing technologies and products developed by our competitors. The process of developing new technology is complex, costly and uncertain. To the extent we are not able to adapt to new technologies and/or standards, experience delays in implementing adaptive measures or fail to accurately predict emerging technological trends and the changing needs or preferences of users, we may lose customers.

The requirements of being a public company may strain our resources and divert management’s attention, and the increases in legal, accounting and compliance expenses may be greater than we had anticipated.